Medical Transcription Billing, Corp. June 2014 mHealth EHR PM RCM | A Fully Integrated Practice Solution Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333 - 192989 June 17, 2014

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 1 Forward Looking Statements This presentation includes forward - looking statements within the meaning of the federal securities laws. These statements, among other things, relate to our business strategy , goals and expectations concerning our product candidates, future operations , prospects, plans and objectives of management. The words "anticipate", " believe", "could", "estimate", "expect", "intend", "may", "plan", "predict", "project", " will" and similar terms and phrases are used to identify forward - looking statements in this presentation. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward - looking statements ultimately prove to be correct. We have described these risks in our Registration Statement on Form S - 1, as amended, filed with the Securities and Exchange Commission. Before you purchase any of our securities, you should read the Registration Statement to obtain more complete information about our operations, business and the risks and uncertainties that we face in implementing our business plan. We assume no obligation to update any forward - looking statements except as required by applicable law.

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 2 Free Writing Prospectus Statement This presentation highlights basic information about us and the offering. Because it is a summary, it does not contain all of the information that you should consider before investing . We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates. The registration statement has not yet become effective. Before you invest, you should read the prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively , we or any underwriter or dealer participating in the offering will arrange to send you the prospectus if you request it by calling Brendan Harney at (732) 873 - 5133 x. 172 or emailing bharney@MTBC.com .

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 3 Initial Public Offering ▪ 3.0 million (all primary) Shares Offered Price Range ▪ $9.00 - $11.00 per share Post - Offering Shares Outstanding ▪ 9.83 million ▪ 10.28 million with overallotment Underwriters ▪ Chardan Capital Markets ▪ Aegis Capital Corp. ▪ Summer Street Research Partners NASDAQ Symbol ▪ MTBC Use of Proceeds ▪ Cash consideration for the acquisition of target companies ▪ Fund future acquisitions ▪ General corporate purposes Professional Firms ▪ Auditor: Deloitte & Touche LLP ▪ Outside Counsel: Fox Rothschild LLP ▪ Investor Relations: Westwicke Partners

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 4 Healthcare information technology company Scalable, cost - efficient business model ▪ Cloud - based software ▪ Educated, low - cost offshore labor force with over 1,000 employees Predictable recurring revenue with “sticky” customer base Highly experienced management team ▪ Completed and integrated six acquisitions over the past 3 years ▪ Public company and industry experience Solid financial performance Large, highly fragmented market ▪ Consolidator in the highly fragmented healthcare IT market ▪ Over 1,500 RCM companies, none with a 5% market share ▪ Regulatory changes are driving consolidation ▪ Over 700 EHRs certified for MU Stage 1; less than 20% certified for MU Stage 2, as of May 1, 2014 ▪ 95% of revenue visibility at the beginning of each quarter ▪ 90% renewal rate for clients that utilize our EHR solution ▪ Track record of six consecutive years of EBITDA - positive operations ▪ Ability to realize significant operating leverage post - acquisitions Investment Highlights ▪ Proprietary, fully integrated, SaaS and service solution ▪ Mobile Health (“mHealth”) ▪ Electronic Health Record (“EHR”) ▪ Practice Management (“PM”) ▪ Revenue Cycle Management (“RCM”)

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 5 Integrated Ambulatory Solutions ▪ Meaningful U se Stage 2 certified ▪ Integrated lab orders and results ▪ Electronic prescribing * ▪ Secure messaging * ▪ Clinical charting * ▪ Drug and allergy alerts ▪ 24x7 technical support ▪ Development/hosting of practice website ▪ Patient appointment reminders * ▪ Administrative dashboard ▪ Patient portal * ▪ Real time business intelligence ▪ Deductible verification * ▪ Eligibility checking * ▪ Claims scrubbing * ▪ Denial management ▪ A/R Tracking ▪ ICD - 10 compliant ▪ Live patient support mHealth applications extend the core functionality of the EHR, PM and RCM platform to mobile devices ▪ Secure patient communication portal * ▪ Online appointment scheduling * ▪ Customizable SMS alerts * ▪ Automated preventive care scheduling ▪ Transcription services * * Identifies functionality that is also available through our mHealth applications Practice Management Solution Electronic Health Records Revenue Cycle Management

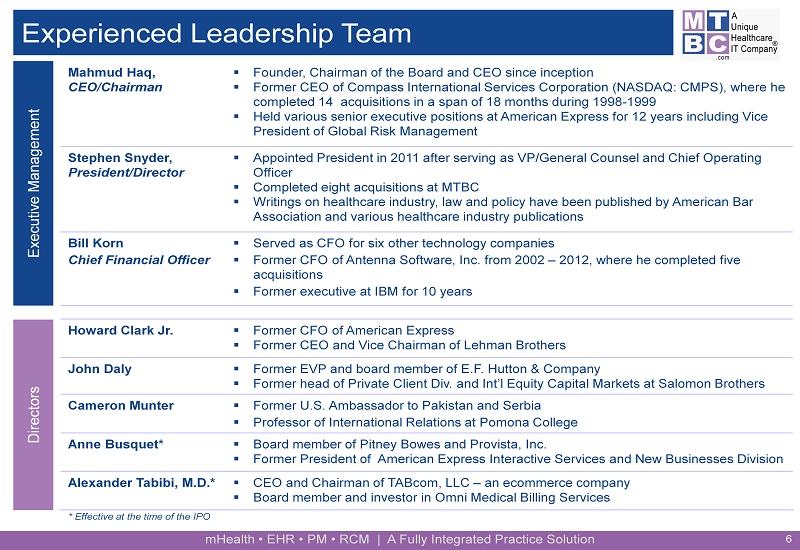

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 6 Experienced Leadership Team Mahmud Haq, CEO/Chairman ▪ Founder, Chairman of the Board and CEO since inception ▪ Former CEO of Compass International Services Corporation (NASDAQ: CMPS), where he completed 14 acquisitions in a span of 18 months during 1998 - 1999 ▪ Held various senior executive positions at American Express for 12 years including Vice President of Global Risk Management Stephen Snyder, President/Director ▪ Appointed President in 2011 after serving as VP /General Counsel and Chief Operating Officer ▪ Completed eight acquisitions at MTBC ▪ Writings on healthcare industry, law and policy have been published by American Bar Association and various healthcare industry publications Bill Korn Chief Financial Officer ▪ Served as CFO for six other technology companies ▪ Former CFO of Antenna Software, Inc. from 2002 – 2012, where he completed five acquisitions ▪ Former executive at IBM for 10 years Howard Clark Jr. ▪ Former CFO of American Express ▪ Former CEO and Vice Chairman of Lehman Brothers John Daly ▪ Former EVP and board member of E.F. Hutton & Company ▪ Former head of Private Client Div. and Int’l Equity Capital Markets at Salomon Brothers Cameron Munter ▪ Former U.S. Ambassador to Pakistan and Serbia ▪ Professor of International Relations at Pomona College Anne Busquet* ▪ Board member of Pitney Bowes and Provista, Inc. ▪ Former President of American Express Interactive Services and New Businesses Division Alexander Tabibi, M.D.* ▪ CEO and Chairman of TABcom, LLC – an ecommerce company ▪ Board member and investor in Omni Medical Billing Services Executive Management Directors * Effective at the time of the IPO

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 7 MTBC Vision MTBC Pro Forma Revenue: $11.6 million* *Includes full year revenue from Metro Medical acquired on June 30, 2013 Omni Medical Billing Services, LLC Revenue: $11.3 million Purchase price: $20.7 million Practicare Medical Management, Inc. Revenue: $4.6 million Purchase price: $6.2 million 7 To be a leading provider of integrated SaaS and business service solutions to healthcare providers practicing in the ambulatory setting by utilizing leading - edge technology and cost - effective labor Business Overview ▪ Pro forma TTM Revenue: $ 32.5 million ▪ Headquarters : New Jersey ▪ 930 practices representing 2,020 providers * Target Acquisition Terms ▪ Asset purchases ▪ Approximately 50% cash, 50% stock ▪ Price adjustment for lost revenue after one year ▪ Operating management retained CastleRock Solutions, Inc. (subsidiaries of) Revenue: $5.0 million Purchase price: $7.3 million * On a pro forma basis All revenues represent the four quarters ended March 31, 2014.

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 8 Industry Overview ▪ The US ambulatory EHR / RCM industry represents a $13b+ opportunity ▪ a thenahealth is the largest market participant with a market share of only 4.5% ▪ The Institute of Medicine estimates that 30% of health care spending – roughly $750 billion – is wasted annually on unnecessary services, excessive administrative costs, fraud, and other problems ▪ Affordable Care Act and related regulatory / reimbursement changes are creating unprecedented challenges for smaller EHR / RCM vendors ▪ 9 out of 10 physicians state a preference for a single - source vendor for all EHR, PM and RCM solutions EHR Meaningful Use Road Map RCM ICD - 9 to ICD - 10 Fully Integrated Solution ▪ Revenue: $632 million* ▪ Market Cap: $4.9 billion** ▪ NASDAQ: ATHN EHR Only Solution ▪ $149 million in funding raised ▪ Provides free EHR ▪ Potential IPO in 2015 Niche Market Solution ▪ Revenue: $19 million* ▪ Market Cap: $1.2 billion** ▪ NYSE:CSLT ▪ Focus on payers, not providers * 4 quarters ended Q1 2014 revenue **As of close of trading June 6, 2014 Source: Black Book Rankings, 2013 User Survey

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 9 An Emerging Leader in the EHR Space Source: KLAS EMR Report, January 2014 KLAS EHR Rankings: 1 - 10 Provider Practices

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 10 Performance Based Retention Higher Claims First - Pass Acceptance Rates Annual Renewal Rates* 2012 - 2013 MTBC’s focus on customer satisfaction leads to high customer retention 98% 94% 40% 60% 80% 100% First-time pass rate MTBC Industry Average Renewal rates exceed 95% for practices ‘meaningfully using’ our EHR 32 36 20 25 30 35 40 Primary Care MTBC Industry Average Reduced Days in Accounts Receivable 85% 90% 0% 20% 40% 60% 80% 100% All Clients EHR Clients * Renewal rate includes acquired practices one year after the date of acquisition and excludes practices that go out of busines s o r are acquired by hospital systems. Source: American Medical Association, 2007 industry report Source: Medical Group Management Association

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 11 Competitive Advantage ▪ Over 1,000 Pakistan - based employees with over 170 dedicated technology professionals ▪ Highly educated workforce ▪ Redundant backup facility four hours away ▪ ISO 27001 certified ▪ HIPAA compliant Pakistan labor costs are approximately one - half the cost of India - based employees 20% 10% 0% 25% 50% 75% 100% USA India Pakistan Comparative Labor Cost ▪ Pakistan operations allow MTBC to realize significant reductions in expenses of acquired companies, at approximately half the cost of India - based labor

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 12 Growth Strategy Standalone EHR Providers Standalone RCM Providers ICD - 10 ▪ Consolidate small providers ▪ Rationalize costs to Pakistan Stage 2 1,500+ 500+ January 2014 Both opportunities allow MTBC to acquire customers in large quantities ▪ Partner with EHRs that lack an integrated solution ▪ Cross - sell MTBC solutions Acquisition Organic Industry Pressures Regulatory Timing MTBC Growth Strategy Number of Challenged Vendors October 2015

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 13 Acquisition Strategy 16 acquisition targets identified with $170 million in revenues * Leverage lower cost into EBITDA growth Migrate customers to MTBC platform Acquire ambulatory RCM companies * Based on company’s preliminary communications with potential targets

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 14 Organic Growth through Channel Partners ▪ MTBC leverages partners’ marketing budgets and converts potential competitors into low - cost channel partners ▪ 70% of the 500k+ ambulatory physicians practice in MTBC’s target market of the 1 - 10 physician practice groups • Leading EHR with more than 7,000 attested providers • Integration between partner’s EHR and MTBC’s RCM and PM • Partner promotes MTBC and provides qualified leads • Regional EHR struggling to attain MU 2 readiness • MTBC leads MU 2 development and partner integration • MTBC serves as exclusive referred partner for RCM and PM • Provider of paper - based solution pivoting to cloud platform • Integration between MTBC’s EHR and partner’s platform • Partner promotes MTBC’s RCM and PM solutions Other Integrated Solutions:

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 15 mHealth

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 16 Electronic Health Record

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 17 Business Intelligence

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 18 Practice Management System Aging Widget

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 19 Revenue Model ▪ Pricing is among the most competitive in the industry ▪ A ligns MTBC with financial goals of customer ▪ Offering includes an integrated mHealth, EHR , practice management solution and dozens of other business services and applications for one all - inclusive fee ▪ One year customer contracts , auto - renew unless 90 day notice of cancellation ▪ All system updates and upgrades are conducted seamlessly through a cloud - based network without additional charges to customer ▪ Optional services include transcription, coding, consulting, integration with third - party EHR platforms Standard offered fee for complete, integrated solution is 5% of a practice’s revenues, plus a nominal setup fee

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 20 Recent Acquisition Case Study ▪ MTBC acquired Metro Medical, with annual revenue of $3 million, on June 30, 2013 for $1.5 million ▪ Reduced directly identifiable expenses from 111% of revenue prior to acquisition to 55% of revenue ▪ 98% of critical operations workflow moved offshore in the first 60 days ▪ Monthly operating expenses reduced by 52% within nine months ▪ US employees reduced from 54 to 7 within one year ▪ Retained 89% of revenue and migrated 81% of customers to MTBC’s software solution in nine months ▪ Cumulative positive cash flow achieved in December 2013 20 0% 25% 50% 75% 100% 125% Q1 2013 Prior to Acquisition Q2 2013 Prior to Acquisition Q3 2013 Q4 2013 Q1 2014 % of Revenue Metro Medical's Cost Reductions Directly Identifiable Expenses as a % of Revenue - 10 20 30 40 50 60 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 Prior to Acquisition Metro Employees (US)

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 21 NOTES: 1) Historical revenue and EBITDA include acquisition of Metro Medical starting June 30, 2013 2) Pro Forma revenue and EBITDA include acquisition of 3 target companies for the four quarters ended Q1 2014 3) EBITDA * reduced by non - recurring extraordinary costs to prepare for IPO and acquisitions of target companies : approximately $300,000 in 2013 and $500,000 in the 4 quarters ended Q1 2014 4) Pro Forma EBITDA reflects target companies running independently, with no savings from technology or offshore team * non - GAAP term Historical and Pro Forma Financials MTBC Standalone Pro Forma EBITDA Margin 10% 7% $6.5 $10.5 $10.8 $32.5 2009 2013 (1) 4 Quarters Ended Q1 2014 (1) Pro Forma Revenue (2) $0 $10 $20 $30 Historical MTBC Stand - alone Revenue $1.0 $1.1 $0.6 $2.2 2009 2013 (1) (3) 4 Quarters Ended Q1 2014 (1) (3) Pro Forma EBITDA (2) (4) $0.0 $1.0 $2.0 Historical MTBC Stand - alone EBITDA EBITDA Revenue (all $ in millions)

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 22 Pro Forma Capitalization ($’s in millions) As of March 31, 2014 Pro Forma for Acquisitions and IPO Cash & Cash Equivalents $7.8 Working Capital $6.2 Long - Term Debt $1.0 Total Equity $40.2 Note: Pro Forma for Acquisitions and IPO includes a $30 million IPO as well as conversion of convertible note

mHealth • EHR • PM • RCM | A Fully Integrated Practice Solution 23 Healthcare information technology company Scalable, cost - efficient cloud - based business model Predictable recurring revenue with “sticky” customer base Highly experienced management team Solid financial performance Large, highly fragmented market Investment Highlights Practice Management Solution Electronic Health Records Revenue Cycle Management mHealth Solutions