UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark one)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission

File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| ||

| (Address of principal executive offices) |

|

(Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Global Market | ||||

| Global Market | ||||

| Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller

reporting company |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

As

of June 30, 2021, the aggregate market value of the registrant’s common stock held by non-affiliates

of the registrant was approximately $

At February 28, 2022, the registrant had shares of common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| 1 |

Forward-Looking Statements

Certain statements that we make from time to time, including statements contained in this Annual Report on Form 10-K, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact contained in this Annual Report on Form 10-K are forward-looking statements. These statements relate to anticipated future events, future results of operations or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “intends,” “expects,” “plans,” “goals,” “projects,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Forward-looking statements in this Annual Report on Form 10-K include, without limitation, statements reflecting management’s expectations for future financial performance and operating expenditures (including our ability to continue as a going concern, to raise additional capital and to succeed in our future operations), expected growth, profitability and business outlook, increased sales and marketing expenses, and the expected results from the integration of our acquisitions.

Forward-looking statements are only predictions, are uncertain and involve substantial known and unknown risks, uncertainties, and other factors that may cause our (or our industry’s) actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements. These factors include, among other things, the unknown risks and uncertainties that we believe could cause actual results to differ from these forward-looking statements as set forth under the heading, “Risk Factors” and elsewhere in this Annual Report on Form 10-K. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all of the risks and uncertainties that could have an impact on the forward-looking statements, including without limitation, risks and uncertainties relating to:

| ● | our ability to manage our growth, including acquiring, partnering with, and effectively integrating acquired businesses into our infrastructure and avoiding legal exposure and liabilities associated with acquired companies and assets; | |

| ● | our ability to retain our clients and revenue levels, including effectively migrating new clients and maintaining or growing the revenue levels of our new and existing clients; | |

| ● | our ability to maintain operations in our offshore offices in a manner that continues to enable us to offer competitively priced products and services; | |

| ● | our ability to keep pace with a rapidly changing healthcare industry; | |

| ● | our ability to consistently achieve and maintain compliance with a myriad of federal, state, foreign, local, payor and industry requirements, regulations, rules, laws and contracts; | |

| ● | our ability to maintain and protect the privacy of confidential and protected Company, client and patient information; | |

| ● | our ability to develop new technologies, upgrade and adapt legacy and acquired technologies to work with evolving industry standards and third-party software platforms and technologies, and protect and enforce all of these and other intellectual property rights; | |

| ● | our ability to attract and retain key officers and employees, and the continued involvement of Mahmud Haq as Executive Chairman and A. Hadi Chaudhry as Chief Executive Officer and President, all of which are critical to our ongoing operations, growing our business and integrating our newly acquired businesses; | |

| ● | our ability to comply with covenants contained in our credit agreement with our senior secured lender, Silicon Valley Bank and other future debt facilities; | |

| ● | our ability to pay our monthly preferred dividends to the holders of our Series A and Series B preferred stock (“Preferred Stock”); |

| 2 |

| ● | our ability to compete with other companies developing products and selling services competitive with ours, and who may have greater resources and name recognition than we have; | |

| ● | our ability to respond to the uncertainty resulting from the ongoing COVID-19 pandemic and the impact it may have on our operations, the demand for our services, and economic activity in general; and | |

| ● | our ability to keep and increase market acceptance of our products and services. |

Although we believe that the expectations reflected in the forward-looking statements contained in this Annual Report on Form 10-K are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of such forward-looking statements, whether as a result of new information, future events, or otherwise, after the date of this Annual Report on Form 10-K.

Summary Risk Factors

The following is a summary of the principal risks and uncertainties that could materially adversely affect our business, financial condition and results of operations. You should read this summary together with the more detailed description of each risk factor contained in “Risk Factors” in Part 1, Item 1A below.

Risks Related to Our Acquisition Strategy

| ● | If we do not manage our growth effectively, our revenue, business and operating results may be harmed. |

| ● | We may be unable to retain customers following an acquisition, which may result in a decrease in our revenues and operating results. |

| ● | Acquisitions may subject us to liability with regard to the creditors, customers, and shareholders of the sellers. |

| ● | We may be unable to implement our strategy of acquiring additional companies. |

| ● | Future acquisitions may result in potentially dilutive issuances of equity securities, the incurrence of indebtedness and increased amortization expense. |

Risks Related to our Business

| ● | Our business, financial condition, results of operations and growth could be harmed by the effects of the ongoing COVID-19 pandemic. |

| ● | We operate in a highly competitive industry, and our competitors may be able to compete more efficiently or evolve more rapidly than we do, which could have a material adverse effect on our business, revenue, growth rates and market share. |

| ● | If we are unable to successfully introduce new products or services or fail to keep pace with advances in technology, we would not be able to maintain our customers or grow our business, which will have a material adverse effect on our business. |

| ● | The continued success of our business model is heavily dependent upon our offshore operations, and any disruption to those operations will adversely affect us. |

| ● | Our offshore operations expose us to additional business and financial risks which could adversely affect us and subject us to civil and criminal liability. |

| ● | Changes in the healthcare industry could affect the demand for our services and may result in a decrease in our revenues and market share. |

| ● | If providers do not purchase our products and services or delay in choosing our products or services, we may not be able to grow our business. |

| ● | If the revenues of our customers decrease, or if our customers cancel or elect not to renew their contracts, our revenue will decrease. |

| ● | We have incurred operating losses and net losses, and we may not be able to achieve or subsequently maintain profitability in the future. |

| ● | As a result of our variable sales and implementation cycles, we may be unable to recognize revenue from prospective customers on a timely basis and we may not be able to offset expenditures. |

| 3 |

| ● | As a result of the Wayfair decision and changes in various states’ laws, we are required to collect sales and use taxes on certain products and services we sell in certain jurisdictions. We may be subject to liability for past sales and incur additional related costs and expenses, and our future sales may decrease. |

| ● | If we lose the services of Mahmud Haq as Executive Chairman, A. Hadi Chaudhry as Chief Executive Officer and President, or other members of our management team, or if we are unable to attract, hire, integrate and retain other necessary employees, our business would be harmed. |

| ● | We may be unable to adequately establish, protect or enforce our patents, trade secrets and other intellectual property rights. |

| ● | Claims by others that allege we infringe or may infringe on their intellectual property could force us to incur significant costs or revise the way we conduct our business. |

| ● | We may be unable to protect, and we may incur significant costs in enforcing, our intellectual property rights. |

| ● | Current and future litigation against us could be costly and time-consuming to defend and could result in additional liabilities. |

| ● | Our proprietary software or service delivery platform, including the platforms we have acquired, may not operate properly, which could damage our reputation, give rise to claims against us, or divert application of our resources from other purposes, any of which could harm our business and operating results. |

| ● | If our security measures are breached or fail, and unauthorized access is obtained to a customer’s data, our service may be perceived as insecure, the attractiveness of our services to current or potential customers may be reduced, and we may incur significant liabilities. |

| ● | Our products and services are required to meet the interoperability standards, which could require us to incur substantial additional development costs or result in a decrease in revenue. |

| ● | Disruptions in internet or telecommunication service or damage to our data centers could adversely affect our business by reducing our customers’ confidence in the reliability of our services and products. |

| ● | We may be subject to liability for the content we provide to our customers and their patients. |

| ● | We are subject to the effect of payer and provider conduct that we cannot control and that could damage our reputation with customers and result in liability claims that increase our expenses. |

| ● | Failure by our clients to obtain proper permissions and waivers may result in claims against us or may limit or prevent our use of data, which could harm our business. |

| ● | Any deficiencies in our financial reporting or internal controls could adversely affect our business and the trading price of our securities. |

| ● | We identified a material weakness in our internal controls over financial reporting related to a non-routine transaction. |

| ● | We are a party to several related-party agreements with our founder and Executive Chairman, Mahmud Haq, which have significant contractual obligations. |

| ● | We depend on key information systems and third-party service providers. |

| ● | Systems failures or cyber-attacks and resulting interruptions in the availability of or degradation in the performance of our websites, applications, products or services could harm our business. |

| ● | Rapid technological change in the telehealth industry presents us with significant risks and challenges. |

Regulatory Risks

| ● | The healthcare industry is heavily regulated. Our failure to comply with regulatory requirements could create liability for us, result in adverse publicity and negatively affect our business. |

| ● | If we do not maintain the certification of our EHR solutions pursuant to the HITECH Act, our business, financial condition and results of operations will be adversely affected. |

| ● | If a breach of our measures protecting personal data covered by HIPAA or the HITECH Act occurs, we may incur significant liabilities. |

| ● | If we or our customers fail to comply with federal and state laws governing submission of false or fraudulent claims to government healthcare programs and financial relationships among healthcare providers, we or our customers may be subject to civil and criminal penalties or loss of eligibility to participate in government healthcare programs. |

| ● | Potential healthcare reform and new regulatory requirements placed on our products and services could increase our costs, delay or prevent our introduction of new products or services, and impair the function or value of our existing products and services. |

| ● | Additional regulation of the disclosure of medical information outside the United States may adversely affect our operations and may increase our costs. |

| ● | Our services present the potential for embezzlement, identity theft, or other similar illegal behavior by our employees. |

| 4 |

Risks Related to Ownership of Shares of Our Common Stock

| ● | Our revenues, operating results and cash flows may fluctuate in future periods and we may fail to meet investor expectations, which may cause the price of our common stock to decline. |

| ● | Future sales of shares of our common stock could depress the market price of our common stock. |

| ● | Mahmud Haq currently controls 30.1% of our outstanding shares of common stock, which will prevent investors from influencing significant corporate decisions. |

| ● | Provisions of Delaware law, of our amended and restated charter and amended and restated bylaws may make a takeover more difficult, which could cause our common stock price to decline. |

| ● | Any issuance of additional preferred stock in the future may dilute the rights of our existing stockholders. |

| ● | We do not intend to pay cash dividends on our common stock. |

| ● | Complying with the laws and regulations affecting public companies may increase our costs and the demands on management, and could harm our operating results. |

| ● | We are a smaller reporting company and we cannot be certain if the reduced disclosure requirements applicable to smaller reporting companies will make our common stock less attractive to investors. |

Risks Related to Ownership of Shares of Our Preferred Stock

| ● | Our Series A and Series B preferred stock (“Preferred Stock”) ranks junior to all of our indebtedness and other liabilities. |

| ● | We may not be able to pay dividends on the Preferred Stock if we fall out of compliance with our loan covenants and are prohibited by our bank lender from paying dividends or if we have insufficient cash to make dividend payments. |

| ● | We may issue additional shares of Preferred Stock and additional series of preferred stock that rank on parity with the Preferred Stock as to dividend rights, rights upon liquidation or voting rights. |

| ● | Market interest rates may materially and adversely affect the value of the Preferred Stock. |

| ● | Holders of the Preferred Stock may be unable to use the dividends-received deduction and may not be eligible for the preferential tax rates applicable to “qualified dividend income”. |

| ● | Our Preferred Stock has not been rated. |

| ● | We may redeem the Series A Preferred Stock at any time, including 800,000 shares of Series A Preferred Stock that we intend to redeem on March 18, 2022, and may redeem the Series B Preferred Stock after February 15, 2024. |

| ● | The market price of our Preferred Stock is variable and could be substantially affected by various factors. |

| ● | A holder of Preferred Stock has extremely limited voting rights. |

| ● | The

Preferred Stock is not convertible, and investors will not realize a corresponding upside

if the price of the common stock increases. |

| 5 |

PART I

Item 1. Business

Overview

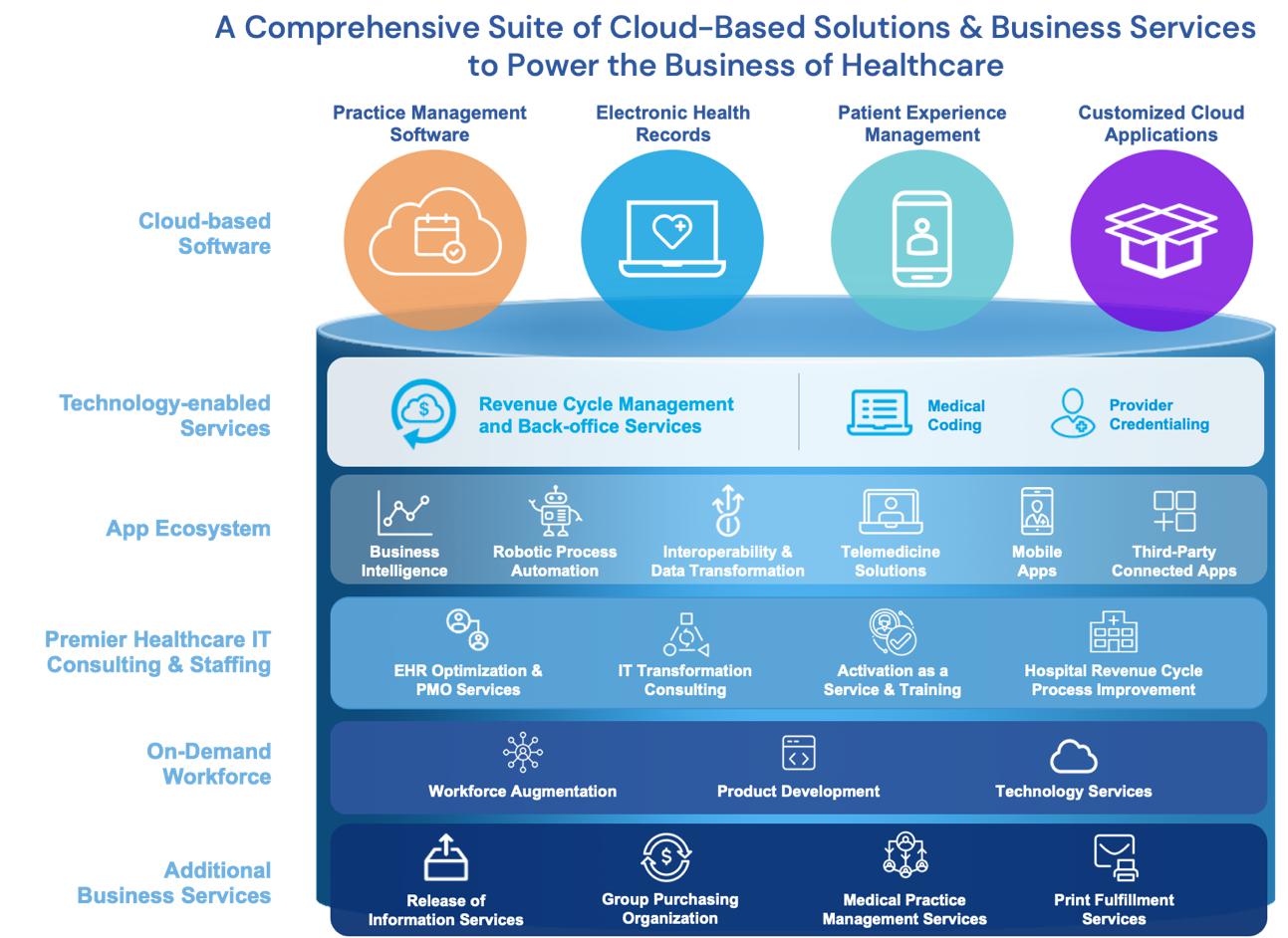

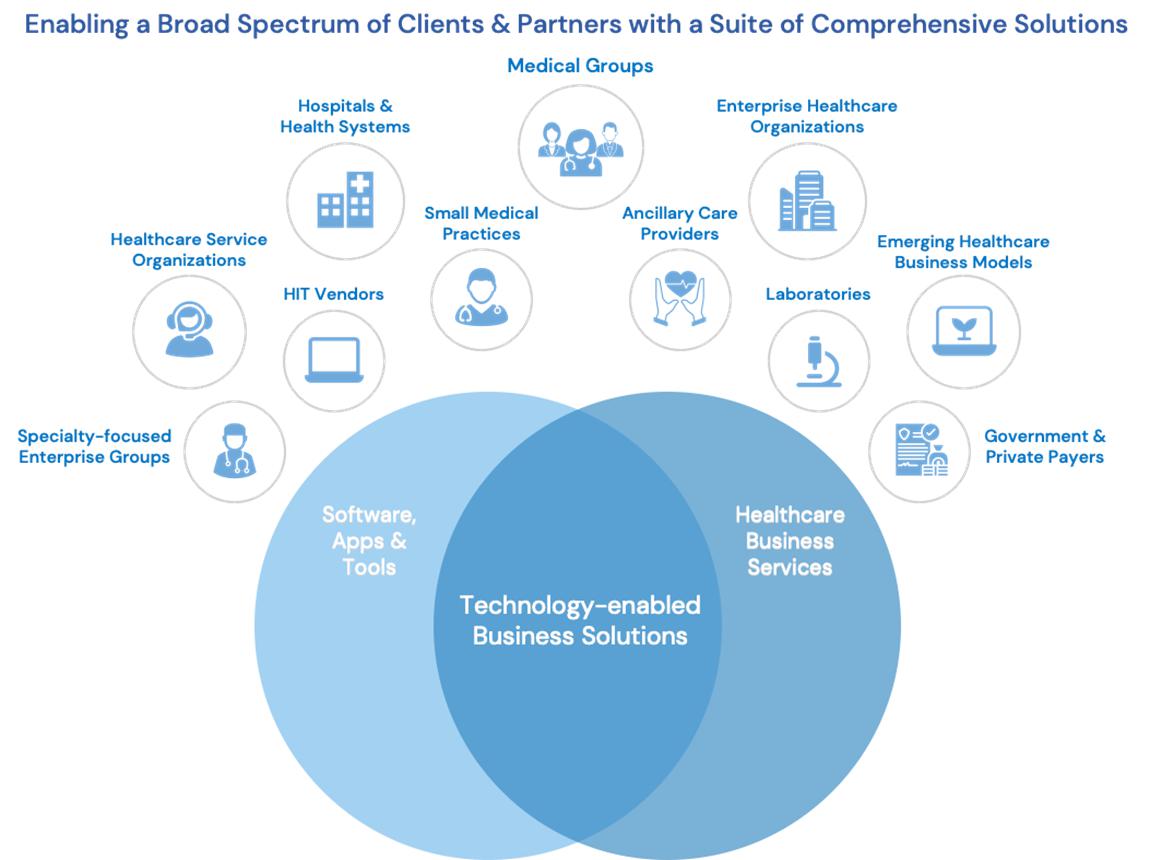

CareCloud, Inc., formerly MTBC, Inc. (“CareCloud,” and together with its consolidated subsidiaries, the “Company,” “we,” “us” and/or “our”) is a leading healthcare information technology company that provides a full suite of proprietary cloud-based solutions and related business services, to healthcare providers, from small practices to enterprise medical groups, hospitals, and health systems throughout the United States. Healthcare organizations today operate in highly complex and regulated environments, and our suite of technology-enabled solutions helps our clients increase financial and operational performance, streamline clinical workflows, and improve the patient experience. Our Software-as-a-Service (“SaaS”) platforms include practice management (“PM”), electronic health record (“EHR”), business intelligence, telehealth, patient experience management (“PXM”) solutions, and robotic processing automation (“RPA”) bots, along with complementary software tools and business services such as revenue cycle management (“RCM”), premiere healthcare consulting and implementation services, and on-demand workforce staffing capabilities for high-performance medical groups and health systems nationwide.

At a high level, these solutions can be categorized as follows:

| ● | Technology-enabled business solutions, which are sometimes provided as individual SaaS offerings and often provided in combination with each other, including: |

| ○ | EHRs, which are easy to use and sometimes integrated with our business services, and enable our healthcare provider clients to deliver better patient care, streamline their clinical workflows, decrease documentation errors and potentially qualify for government incentives; |

| ○ | PM software and related capabilities, which support our clients’ day-to-day business operations and financial workflows, including automated insurance eligibility software, a robust billing and claims rules engine and other automated tools designed to maximize reimbursement; |

| ○ | PXM solutions designed to transform interactions between patients and their clinicians, including smartphone applications that assist patients and healthcare providers in the provision of healthcare services, including contactless digital check-in solutions, messaging and online appointment scheduling tools; |

| ○ | An RPA solution that leverages the power of our own proprietary healthcare-specific microbots, designed to automate routine financial and clinical workflows across the healthcare industry. Our solution allows clients to automate costly, labor-intensive tasks, alleviate the surge in demand for additional labor while driving efficiencies across a large array of healthcare settings nationwide; |

| ○ | Telehealth solutions which allow healthcare providers to conduct remote patient visits; |

| ○ | Healthcare claims clearinghouse which enables our clients to electronically scrub and submit claims and process payments from insurance companies; |

| ○ | Business intelligence and healthcare analytics platforms that allow our clients to derive actionable insights from their vast amount of data; |

| ○ | Interoperability and data transformation software to support the complex realities of data exchange with healthcare trading partners, including labs, insurance companies, and other healthcare IT vendors; |

| ○ | RCM services including end-to-end medical billing, eligibility, analytics, and related services, all of which can be provided utilizing our technology platform or through a third-party system; |

| ○ | Customized applications, interfaces and a variety of other technology solutions that support our healthcare clients; |

| ○ | Professional services consisting of application and advisory services, revenue cycle services, data analytic services and educational training services; and |

| ○ | Workforce augmentation and on-demand staffing to support our clients as they expand their businesses, seek highly trained personnel, or struggle with staffing shortages. |

| ● | Medical practice management services are provided to medical practices. In this service model, we provide the medical practice with appropriate facilities, equipment, supplies, support services, nurses, and administrative support staff. We also provide management, bill-paying and financial advisory services. |

Our solutions enable clients to increase financial and operational performance, streamline clinical workflows, get better insight through data, and make better business and clinical decisions, resulting in improvement in patient care and collections while reducing administrative burdens and operating costs.

| 6 |

The modernization of the healthcare industry is transforming nearly every aspect of a healthcare organization from policy to providers; clinical care to member services, devices to data, and ultimately the quality of the patient’s experience as a healthcare consumer.

We create elegant, user-friendly applications that solve many of the challenges facing healthcare organizations. We partner with organizations to develop customized, best-in-class solutions to solve their specific challenges while ensuring they also meet future regulatory and organizational requirements and market demands.

Market Overview

In December 2020, Centers for Medicare & Medicaid Services (“CMS”) reported that national healthcare expenditure in the U.S. grew 9.7% to $4.1 trillion in 2020. U.S healthcare spending will grow 5.4% annually on average during the years 2021 through 2028, reaching $6.2 trillion by 2028. CMS also projected that health spending will grow 1.1% faster than gross domestic product (“GDP”) annually during the years 2021 through 2028; and as a result, the healthcare share of GDP is expected to rise from 17.7% in 2018 to 19.7% by 2028.

Additionally, analysts from Markets & Markets have estimated the US Healthcare IT industry market to be approximately $177 billion with its largest sub-segment RCM at approximately $87 billion in 2019, growing at a 12% compound annual growth rate (“CAGR”). The North American EHR market has been estimated to be approximately $40 billion, growing at a CAGR of 6% per year. The Analytics and AI sub-segment was estimated to be approximately $30 billion, growing at a 27% CAGR and the Telehealth market is estimated to be approximately $20 billion with a CAGR of 17%. Standalone billing and practice management solutions are reported to be declining in the market today as medical practices move towards integrated, end-to-end systems that incorporate front and back-office data flows, provide seamless access to clinical data from EHRs, and streamline the entire revenue cycle management process.

| 7 |

Our Market Opportunity

Considering the evolving needs of our clients and the market, we believe we continue to be uniquely positioned to provide tremendous value and support for our clients. We believe there are dynamics at play that are significantly increasing market need for our products and services. These market dynamics present opportunities for us to innovate and focus on impacting the day-to-day challenges our clients face as they work to provide excellent patient care, all while managing and expanding their businesses.

Medical practices and health systems alike are transitioning to increasingly complex reimbursement delivery models. As an example, the industry has been gradually shifting from fee-for-service payments to value-based/clinical outcomes-based care payments. This transition comes in a multitude of forms including reimbursement models associated with quality incentive programs, capitation payments models, bundled payments, and at-risk payer contracts.

There are continuing legislative and regulatory reform efforts, as well as growing compliance requirements mandated by the federal government and other governmental agencies. This ever-evolving regulatory landscape increases the pressure placed on healthcare organizations to stay abreast of these changes and in compliance. The complexities associated with emerging reimbursement models and continued government regulations present opportunities for us as healthcare organizations seek out partners that offer a broad range of software and services to help meet their needs.

Our clients also have to factor in the rising cost of health insurance, changes in health benefit plan design, and the impact that these factors have had on the increase in patient consumerism. Patients are seeking lower cost care in response to insurance carriers shifting more of the cost burden onto patients, causing healthcare organizations to reconsider the full patient experience. Healthcare providers now need to think more deeply about patient expectations. This is especially true as COVID-19 has reshaped the sector and accelerated its digital transformation.

Strategic-thinking healthcare organizations across the country are aggressively addressing these new realities and are finding opportunities for growth and expansion. We see medical groups across the country and within all specialties and market segments, growing through consolidation and investing in their businesses at an accelerated pace. This is also leading clients to focus on delivering emerging and disruptive care delivery settings. Much of this change is driving executives and leaders to assess their IT and data strategy and reevaluate what it means for the future of their organizations.

The healthcare industry has seen tremendous change over the past decade. Our study of the evolving needs of our clients leads us to believe that there will be a continuing need for our services and products and emerging needs for the products and services that we are already developing. These trends will fuel growth over the next several years. In order for healthcare organizations to continue to succeed, these new realities require robust solutions and careful execution. Legacy tools that once powered these healthcare organizations are insufficient to support their growth and long-term strategies. Our solutions facilitate the transition needed by these organizations to drive their future growth. Our expansive product and services portfolio enables us to displace competitors and gain market share across a vast array of specialties, care settings and customer segments across the country.

Our Business Strategy

Our objective is to be a market leading provider of integrated, end-to-end SaaS and business services solutions to healthcare organizations. Our mission is to create flexible and comprehensive products and services to help our clients with the business of medicine. To that end, we invest significant resources toward improving our current offerings and building new solutions that help transform our clients’ organizations. We expect to have increased software capabilities and offer additional complementary business services that will address the needs of the ever-changing, dynamic market conditions of the U.S. healthcare space.

To achieve our objective and mission, we employ the following strategies:

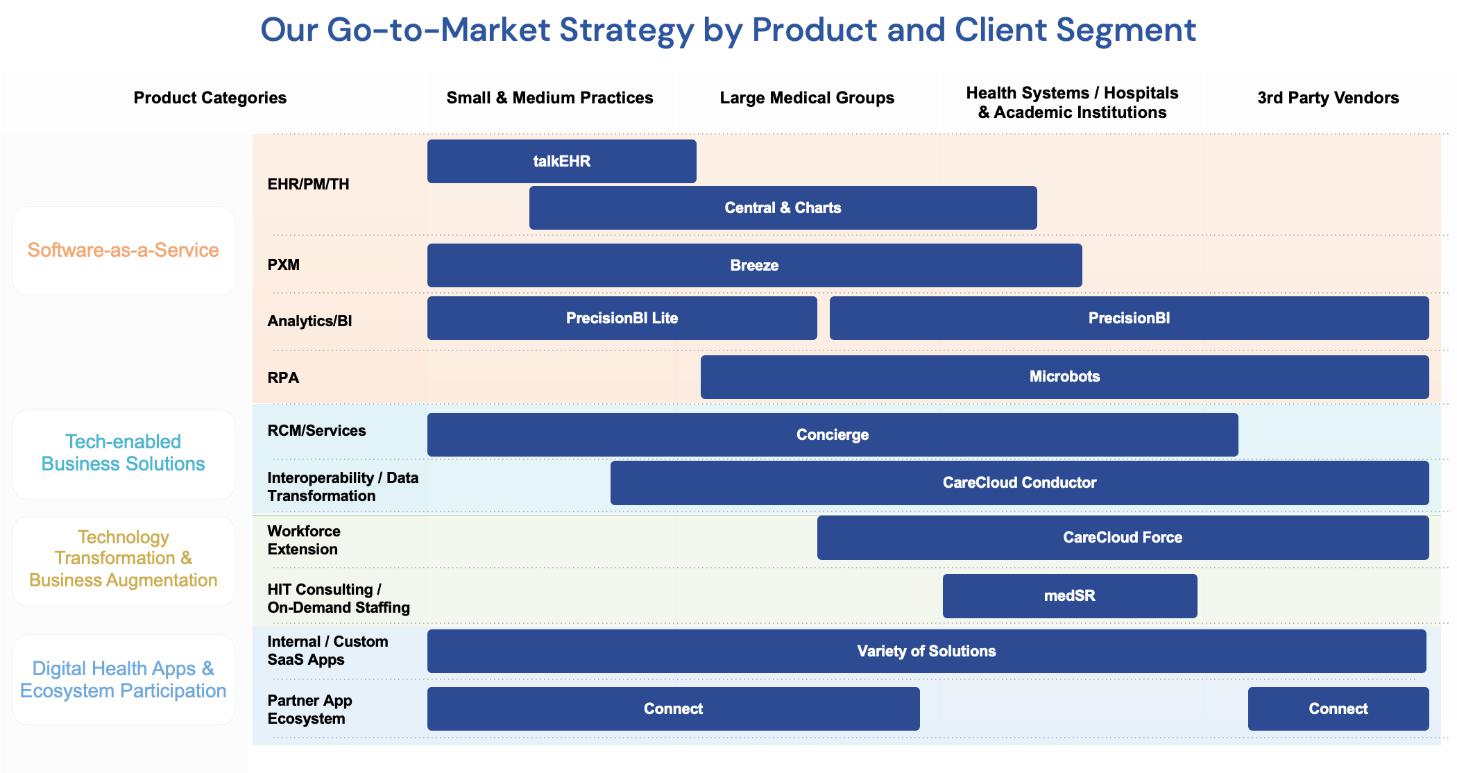

Providing comprehensive product and services suite to medical practices and hospitals. We believe that healthcare providers are in need of an integrated, end-to-end solution and a flexible service delivery model to manage the different facets of their businesses, from care delivery software, to claim submission, financial reporting, and data analytics.

| 8 |

Enhancing our solutions. We intend to continue to enhance our solutions with new functionality and features leveraging our own teams, partnerships, and acquisitions. We will continue to dedicate significant resources to research and development to bolster our existing applications and drive new opportunities for innovation on behalf of our clients.

Expanding into new categories/specialties/markets. We are focused on always reassessing the market landscape, seeking new opportunities to meet the needs of the clients in our addressable market with our products and services. This means developing new and exciting technologies, launching new services, entering new specialties that can leverage our solutions and enabling growth for our clients or expanding into adjacent markets that we may not serve today.

Expanding our client base. We believe the market for our expansive value proposition is underserved, and we will continue to make investments to capture market share. We will invest in our sales and marketing activities, partners, and products to expand our client footprint.

Extending our relationships with existing clients. We intend to increase the number of SaaS subscription licenses and services purchased by our current clients as they use our solutions. We are also focused on converting SaaS clients into higher revenue per client offerings such as revenue cycle management and other business services. This expansion of services typically represents a 3-4x increase in overall revenue per client.

Strengthening our client community. We realize that our success is tied directly to our clients’ success. Accordingly, a substantial portion of our highly trained and educated workforce is devoted to client service.

Leveraging significant cost advantages provided by our technology and global workforce. Our unique business model includes our web-based software and a cost-effective offshore workforce located in Pakistan, Azad Jammu and Kashmir, and Sri Lanka (together, the “Offshore Offices”). We believe that this operating model provides us with significant cost advantages compared to other revenue cycle management companies and it allows us to significantly reduce the operational costs of the companies we acquire.

Pursue acquisitions. We intend to continue to pursue acquisitions over time. As with most of our acquisition transactions, our goal is to retain the acquired clients over the long-term and migrate those clients to our platforms soon after closing and cross-sell our products and services to this newly acquired client base. A core component of our model is to strip out expensive third-party software and vendor costs while improving efficiency and scale with our proven operational model and integration methodology.

Developing our partner ecosystem. We offer an integrated partner ecosystem providing healthcare organizations access to a variety of innovative solutions that complement our suite of products and services. Our partner ecosystem is a comprehensive collection of apps, services, specialty solutions, and clinical connections. This is an integral part of our vision to be the premier cloud-based platform for healthcare.

As the market continues to evolve, we may choose to build or partner for some or all of these solutions in order to broaden our product set. In the longer term, we also envision how this will allow for frictionless flow of information and care-coordination capabilities between medical providers and their patients.

Additionally, given the nature of our large data repository, which is ever-growing as each patient encounter is captured, opportunities exist to potentially monetize this data in an identified manner to help improve clinical outcomes and other financial metrics.

| 9 |

Our Offerings

Our solutions are designed to systematically drive clinical quality and patient outcomes, while streamlining staff and provider workflows and reimbursements and to support different settings of care and healthcare models. Our product and service strategy is simple: we build products and deliver solutions that meet clients’ needs.

Our product and services portfolio is organized across six strategic areas:

Cloud-based Software - the core systems that power medical practices across clinical, financial, and patient workflows, including our PM systems, EHR solutions and our PXM applications or customized purpose-built applications.

Technology-enabled Services - software-enabled RCM offerings and other business services, such as medical coding, credentialing, authorization management and the like are geared towards driving patient and insurance collections across the reimbursement life cycle.

Our Apps and App Ecosystem Partners - additional proprietary software products, including our business intelligence platform, robotic process automation bots, CareCloud Conductor, our interoperability and data transformation suite, telemedicine applications, mobile apps and more of those applications that consume our APIs or other interfaces built by the market at large.

Premier Healthcare IT Consulting & Staffing (medSR) - an extensive set of services including EHR vendor-agnostic optimization and activation, project management, IT transformation consulting, process improvement, training, education, and staffing for large healthcare organizations including health systems and hospitals.

On-demand Workforce (CareCloud Force) - leveraging our unique resources, and in turn selling this capacity at scale directly to partners and clients at a reduced rate as compared to other competitors in the same space. These on-demand workforce capabilities include offshore engineering capacity for development and offshore RCM operations personnel.

Additional Business Services - additional services in support of our wide-ranging client base. These include medical practice management services to a select group of medical practices, a group purchasing organization with negotiated discounts with pharmaceutical manufactures containing more than 4,000 physician and mid-level provider members and other ancillary services.

| 10 |

This categorization approach allows us to be both methodical and nimble across the healthcare organizations and market segments we serve while providing us a framework to create solution sets for the market today and more importantly, for what our clients will need tomorrow.

We believe that our fully integrated solutions uniquely address the challenges in the industry. In most cases the standard fee for our complete, integrated, end-to-end solution is based upon a percentage of each client’s healthcare-related revenues, with a monthly minimum fee, plus a nominal one-time setup fee, which is competitively priced.

Research and Development

Our research and development focuses are on enhancing and expanding our service offerings while ensuring all offerings meet regulatory compliance standards. We continually update our software and technology infrastructures, regularly execute releases of new software enhancements, and adapt our offerings to better serve our medical group and health system clients confronting rapid changes in the healthcare market space.

Our agile software development methodology is designed to ensure that each software release is properly designed, built, tested, and released. Our product, engineering, quality assurance and development operations teams are located both onshore and offshore. We complement our internal efforts with services from third-party technology providers for infrastructure, healthcare ecosystem connectivity needs such as prescriptions, clinical laboratories, or specific application requirements.

We also employ product management, user experience and product marketing personnel who work continually on improvements to our products and services design.

Clients

| 11 |

We estimate that as of December 31, 2021, we provided software and services to approximately 40,000 providers (which we define as physicians, nurses, nurse practitioners, therapists, physician assistants and other clinicians that render bills for their services) practicing in approximately 2,600 independent medical practices and hospitals, representing 80 specialties and subspecialties in 50 states allowing for significantly low revenue concentration risk.

In addition, we served approximately 200 clients that are not medical practices, but are primarily service organizations who serve the healthcare community. The foregoing numbers include clients leveraging any of our products or services and are based in part upon estimates where the precise number of practices or providers is unknown.

We service clients ranging from small practices to large groups and health systems. Our clients span from the single doctor independent medical practices to large medical groups, including an enterprise specialty-specific healthcare organization with more than 2,300 providers located across multiple states. We also service large major academic medical institutions, small and large hospitals and health systems with service areas covering millions of patients.

Sales and Marketing

We have developed sales and marketing capabilities aimed at driving growth of our client base, including small medical practices, large groups, and health systems. We expect to expand by selling our complete suite of software and services to new clients and up-selling additional solutions into our existing client base. We have a direct sales force including team members focused on areas such as our CareCloud Force and medSR deals. In addition, our direct sales are augmented through our partner initiatives and marketing campaigns.

Our Growth Levers

We believe that we are in a great position to continue to grow by leveraging a multi-faceted growth strategy:

| 12 |

Organic Growth and Direct Sales

We have organized our sales force into different segments for sales of all of our products and services in order to best address our clients’ needs and our markets. With this design, our sales team can address a client’s specific needs, whether a new client is seeking our products or services for the first time, or a current client is in need of additional solutions.

Our marketing team operates in support of our salesforce and provides specialized demand generation capabilities for sales efforts and product marketing for sales efforts. Our sales approach is consultative in nature for most of our offerings, which generally includes an analysis based on a prospective client’s needs, crafting service proposals, and negotiating contracts that culminate in the commencement of services.

Our go-to-market strategy is designed to meet our customers’ needs. Our vast array of products and services allow us to craft solutions that can meet our customers’ unique needs within a specific product category, client segment, or both. Our latest go-to-market strategy takes this dynamic into account:

Growth through Partnerships

In addition to our direct sales force, we maintain business relationships with third parties that utilize, promote, or support our sales or services within specific industries or geographic regions. Some of these partners are customers through CareCloud Force and others are more traditional channel partners who help promote our solutions. We believe we can further accelerate organic growth through industry participants, whereby we utilize them as channel partners to offer integrated solutions to their clients. We have entered into such engagements with industry participants, and from which we began to derive revenue starting in mid-2014. We have developed application interfaces with numerous EHR systems, together with device and lab integration to support these relationships.

Growth through Acquisitions

The Healthcare IT service industry is highly fragmented, with many local and regional RCM companies serving small medical practices and hospitals. We believe that the industry is ripe for consolidation and that we can achieve significant growth through acquisitions. We further believe that it is becoming increasingly difficult for traditional RCM companies, together with a variety of other healthcare industry vendors and healthcare IT companies, to meet the growing technology and business service needs of healthcare providers without a significant investment in an information technology infrastructure and the utilization of a talented, cost-efficient global team. Since the Company went public in July 2014, we have completed 17 transactions, acquiring complementary assets to grow our business. We typically leverage our technology and our cost-effective offshore team to quickly deliver additional value to the newly acquired customer base, while reducing costs. Often, we will incur initial costs associated with the integration of the acquired business with our existing operations, but this early investment is designed to increase customer satisfaction and retention, while laying the foundation for long-term accretion.

| 13 |

Competition

The market for practice management, EHR and RCM solutions and related services is highly competitive, and we expect competition to increase in the future. We face competition from other providers of both integrated and stand-alone practice management, EHR and RCM solutions, including competitors who utilize a web-based platform and providers of locally installed software systems.

Many of our competitors have longer operating histories, greater brand recognition and greater financial marketing. We also compete with various regional RCM companies, some of which may continue to consolidate and expand into broader markets. We expect that competition will continue to increase as a result of incentives provided by various governmental initiatives, and consolidation in both the information technology and healthcare industries. In addition, our competitive edge could be diminished or completely lost if our competition develops similar offshore operations in Pakistan or other countries, such as India and the Philippines, where labor costs are lower than those in the U.S. (although higher than in Pakistan). Pricing pressures could negatively impact our margins, growth rate and market share.

We believe we have a competitive advantage, as we are able to deliver our industry-leading solutions at competitive prices because we leverage a combination of our proprietary software, which automates our workflows and increases efficiency, together with a global team that includes more than 600 experienced health industry experts onshore. These experts are supported by our highly educated and specialized offshore workforce of approximately 3,400 team members at labor costs that we believe are approximately one-tenth the cost of comparable U.S. employees.

Our unique business model has allowed us to become a leading consolidator in our industry sector, gaining us a reputation for acquiring and positively transforming distressed competitors into profitable operations of CareCloud.

Employees

Including the employees of our subsidiaries, as of December 2021, the Company employed approximately 4,100 people worldwide on a full-time basis. We also utilize the services of a small number of part time employees. In addition, all officers of the Company work on a full-time basis. Over the next twelve months, we anticipate increasing our total number of employees only if our revenues increase, our operating requirements warrant such hiring, or we are hiring for specific functions where we place additional emphasis, such as marketing and sales.

Voting Rights of Our Directors, Executive Officers, and Principal Stockholders

As of December 31, 2021, approximately 35% of both the shares of our common stock and voting power of our common stock are held by our directors and executive officers. Therefore, they have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our Company.

Corporate Information

We were incorporated in Delaware on September 28, 2001, under the name Medical Transcription Billing, Corp., and legally changed our name to MTBC, Inc. in February 2019. On March 29, 2021, we legally changed the name of the Company to CareCloud, Inc. Our principal executive offices are located at 7 Clyde Road, Somerset, New Jersey 08873, and our telephone number is (732) 873-5133. Our website address is www.CareCloud.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Annual Report on Form 10-K, and you should not consider information on our website to be part of this document.

MTBC, CareCloud.com, A Unique Healthcare IT Company, CareCloud and other trademarks and service marks of CareCloud appearing in this Annual Report on Form 10-K are the property of CareCloud. Trade names, trademarks and service marks of other companies appearing in this Annual Report on Form 10-K are the property of their respective holders.

We are a smaller reporting company. As a smaller reporting company, we may take advantage of specified reduced reporting requirements and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As a smaller reporting company, we have reduced disclosure obligations regarding executive compensation in our Annual Report, periodic reports and proxy statements and providing only two years of audited financial statements in our Annual Report and our periodic reports. This year the Company is required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended. Effective with this Form 10-K, the Company is now an accelerated filer.

| 14 |

Where You Can Find More Information

Our website, which we use to communicate important business information, can be accessed at: www.carecloud.com. We make our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports available free of charge on or through our website as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). Materials we file with or furnish to the SEC may also be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Also, the SEC’s website (www.sec.gov) contains reports, proxy and information statements, and other information that we file electronically with the SEC.

Item 1A. Risk Factors

Risks Related to Our Acquisition Strategy

If we do not manage our growth effectively, our revenue, business and operating results may be harmed.

Our strategy is to expand through organic growth, and through synergistic, accretive acquisitions of companies in the business of healthcare IT (“HCIT”) and complementary services. Since 2006, we have completed 27 transactions acquiring the assets or businesses of RCM, HCIT, and related companies. The majority of these transactions have occurred since we went public in July 2014. Our future acquisitions may require greater than anticipated investment of operational and financial resources as we seek to migrate customers of these companies to our solutions. Acquisitions also require the integration of different software and services, assimilation of new employees, diversion of management and IT resources, and increases in administrative costs. Acquisitions may also require additional costs associated with any debt or equity financings undertaken to pay for such acquisitions. We cannot assure you that any acquisition we undertake will be successful. Future growth will also place additional demands on our customer support, sales, and marketing resources, and may require us to hire and train additional employees. We will need to expand and upgrade our systems and infrastructure to accommodate our growth. The failure to manage our growth effectively will materially and adversely affect our business.

We may be unable to retain customers following their acquisition, which may result in a decrease in our revenues and operating results.

Customers of the businesses we acquire often have the right to terminate their service contracts for any reason at any time upon notice of 90 days or less. These customers may elect to terminate their contracts as a result of our acquisition or choose not to renew their contracts upon expiration. Legal and practical limitations on our ability to enforce non-competition and non-solicitation provisions against customer representatives and sales personnel that leave the businesses we acquire to join competitors may result in the loss of customers. In the past, our failure to retain acquired customers has at times resulted in decreases in our revenues. Our inability to retain customers of businesses we acquire could adversely affect our ability to benefit from those acquisitions and to grow our future revenues and operating income.

Acquisitions may subject us to liability with regard to the creditors, customers, and shareholders of the sellers.

While we attempt to limit our exposure to the liabilities associated with the businesses we acquire, we cannot guarantee that we will be successful in avoiding all material liability. Regardless of how we structure the acquisition, whether as an asset purchase, stock purchase, merger or other business combination, creditors, customers, vendors, governmental agencies and other parties at times seek to hold us accountable for unpaid debts, breach of contract claims, regulatory violations and other liabilities that relate to the business we acquired. Disaffected shareholders of the businesses we acquire have also attempted to interfere with our business acquisitions or brought claims against us. We attempt to minimize all of these risks through thorough due diligence, negotiating indemnities and holdbacks, obtaining relevant representations from sellers, procuring insurance coverage and leveraging experienced professionals when appropriate.

| 15 |

We may be unable to implement our strategy of acquiring additional companies.

We have no unconditional commitments with respect to any acquisition as of the date of this Form 10-K. Although we expect that one or more acquisition opportunities will become available in the future, we may not be able to acquire additional companies at all or on terms favorable to us. We will likely need additional financing for such acquisitions, but there is no assurance that we will be able to borrow funds or raise capital through the issuance of our equity on favorable terms. Certain of our larger, better capitalized competitors may seek to acquire some of the companies we may be interested in. Competition for acquisitions would likely increase acquisition prices and result in us having fewer acquisition opportunities.

Depending on the type of businesses we acquire (e.g., RCM, practice management, EHR, etc.), we may have varying cost saving and/or cross-selling opportunities with the acquired business. However, there is no assurance that we will achieve anticipated cost savings and cross-selling on our acquisitions, and failure to do so may mean we overpaid for such acquisitions.

In completing any future acquisitions, we will rely upon the representations, warranties and indemnities made by the sellers with respect to each acquisition as well as our own due diligence investigation. We cannot be assured that such representations and warranties will be true and correct or that our due diligence will uncover all materially adverse facts relating to the operations and financial condition of the acquired companies or their customers. Nor can we be assured that any available insurance will cover all such losses. To the extent that we are required to pay for obligations of an acquired company, or if material misrepresentations exist, we may not realize the expected benefit from such acquisition and we will have overpaid in cash and/or stock for the value received in that acquisition.

Future acquisitions may result in potentially dilutive issuances of equity securities, the incurrence of indebtedness and increased amortization expense.

Future acquisitions may result in dilutive issuances of equity securities, the incurrence of debt, the assumption of known and unknown liabilities, the write-off of software development costs and the amortization of expenses related to intangible assets, all of which could have an adverse effect on our business, financial condition and results of operations.

Risks Related to Our Business

Our business, financial condition, results of operations and growth could be harmed by the effects of the COVID-19 pandemic.

We are subject to risks related to the public health crises such as the global pandemic associated with the coronavirus (COVID-19). In December 2019, a novel strain of coronavirus, SARS-CoV-2, was reported to have surfaced in Wuhan, China. Since then, SARS-CoV-2, and the resulting disease COVID-19, has spread to most countries, and all 50 states within the United States. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. Further, the President of the United States declared the COVID-19 pandemic a national emergency, invoking powers under the Stafford Act, the legislation that directs federal emergency disaster response, and under the Defense Production Act, the legislation that facilitates the production of goods and services necessary for national security and for other purposes. Numerous governmental jurisdictions, including the State of New Jersey where we maintain our principal executive offices, and those in which many of our U.S. and international offices are based, have imposed, and others in the future may impose, “shelter-in-place” orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of COVID-19. Such orders or restrictions, and the perception that such orders or restrictions could occur, have resulted in business closures, work stoppages, slowdowns and delays, work-from-home policies, travel restrictions and cancellation of events, among other effects, thereby negatively impacting our customers, employees, and offices, among others. We may experience further limitations on employee resources in the future, because of sickness of employees or their families.

| 16 |

Healthcare organizations around the world, including our health care provider customers, have faced and will continue to face, substantial challenges in treating patients with COVID-19, such as the diversion of staff and resources from ordinary functions to the treatment of COVID-19, supply, resource and capital shortages and overburdening of staff and resource capacity. In the United States, governmental authorities have at times also recommended, and in certain cases required, that elective, specialty and other procedures and appointments, including certain primary care services, be suspended or canceled to avoid non-essential patient exposure to medical environments and potential infection with COVID-19 and to focus limited resources and personnel capacity toward the treatment of COVID-19. Some or all of these measures and challenges may continue for the duration of the pandemic, which is uncertain, and will disproportionately harm the results of operations, liquidity and financial condition of these health care organizations and our health care provider customers. As a result, our health-care provider customers may seek contractual accommodations from us in the future. To the extent such health-care provider customers experience challenges and difficulties, it will adversely affect our business operation and results of operations. We note, for example, that approximately 60% of our revenue is directly tied to the cash collected by our health-care provider customers, which means that our short-term revenue has and may in the future decline as less patients visit their doctors during periods of social distancing. Further, a recession or prolonged economic contraction as a result of the COVID-19 pandemic could also harm the business and results of operations of our enterprise customers, resulting in potential business closures, layoffs of employees and a significant increase in unemployment in the United States and elsewhere which may continue even after the pandemic. The occurrence of any such events may lead to reduced income for customers and reduced size of workforces, which could reduce our revenue and harm our business, financial condition and results of operations.

The widespread COVID-19 pandemic has resulted in, and may continue to result in, significant volatility and uncertainty in U.S. and international financial markets, reducing our ability to access capital, which could in the future negatively affect our liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 could materially affect our business and the value of our common stock and Preferred Stock.

Further, given the dislocation and government-imposed travel related limitations as a consequence of the COVID-19 pandemic, our ability to complete acquisitions in the near-term may be delayed. Future acquisitions may be subject to difficulties in evaluating potential acquisition targets as a result of the inability to accurately predict the duration or long-term economic and business consequences resulting from the COVID-19 pandemic.

The global outbreak of COVID-19 continues to rapidly evolve. We have taken steps intended to mitigate the effects of the pandemic and to protect our global workforce including, but not limited to: moving a significant portion of our workforce to remote operations when and as needed, enacting social distancing and hygiene guidelines set forth by the Centers for Disease Control and Prevention and World Health Organization at our offices, providing a vaccination program at our global offices, and discontinuing company travel and events, among others. Although we believe we have taken the appropriate actions, we cannot guarantee that these measures will mitigate all or any negative effects of the pandemic. The prolonged impact of the COVID-19 pandemic or a similar health epidemic is highly uncertain and subject to change. We cannot at this time precisely predict what effects the ongoing pandemic will have on our business, results of operations and financial condition, including the uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the pandemic, and the governmental responses to the pandemic. However, we will continue to monitor the COVID-19 situation closely and are committed to continuing to make appropriate changes as and when needed.

We operate in a highly competitive industry, and our competitors may be able to compete more efficiently or evolve more rapidly than we do, which could have a material adverse effect on our business, revenue, growth rates and market share.

The market for practice management, healthcare IT solutions and related services is highly competitive, and we expect competition to increase in the future. We face competition from other providers of both integrated and stand-alone practice management, EHR and RCM solutions, including competitors who utilize a web-based platform and providers of locally installed software systems. Our competitors include larger healthcare IT companies, such as athenahealth, Inc., eClinicalWorks, Allscripts Healthcare Solutions, Inc. and Greenway Medical Technologies, Inc., all of which may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards, regulations or customer needs and requirements. Many of our competitors have longer operating histories, greater brand recognition and greater financial marketing and other resources than us. We also compete with various regional RCM companies, some of which may continue to consolidate and expand into broader markets. We expect that competition will continue to increase as a result of incentives provided by the Health Information Technology for Economic and Clinical Health (“HITECH”) Act, and consolidation in both the information technology and healthcare industries. Competitors may introduce products or services that render our products or services obsolete or less marketable. Even if our products and services are more effective than the offerings of our competitors, current or potential customers might prefer competitive products or services to our products and services. In addition, our competitive edge could be diminished or completely lost if our competition develops similar offshore operations in Pakistan or other countries, such as India and the Philippines, where labor costs are lower than those in the U.S. (although higher than in Pakistan). Pricing pressures could negatively impact our margins, growth rate and market share.

| 17 |

If we are unable to successfully introduce new products or services or fail to keep pace with advances in technology, we would not be able to maintain our customers or grow our business, which will have a material adverse effect on our business.

Our business depends on our ability to adapt to evolving technologies and industry standards and upgrade existing and introduce new products and services accordingly. If we cannot adapt to changing technologies and industry standards, including changing requirements of third-party applications and software and meet the requirements of our customers, our products and services may become obsolete, and our business would suffer significantly. Because both the healthcare industry and the healthcare IT technology market are constantly evolving, our success will depend, in part, on our ability to continue to enhance our existing products and services, develop new technology that addresses the increasingly sophisticated and varied needs of our customers, respond to technological advances and emerging industry standards and practices on a timely and cost-effective basis, educate our customers to adopt these new technologies, and successfully assist them in transitioning to our new products and services. The development of our proprietary technology entails significant technical and business risks. We may not be successful in developing, using, marketing, selling, or maintaining new technologies effectively or adapting our proprietary technology to evolving customer requirements, emerging industry standards or changing third party applications, and, as a result, our business and reputation could materially suffer. We may not be able to introduce new products or services on schedule, or at all, or such products or services may not achieve market acceptance or existing products or services may cease to function properly. A failure by us to timely adapt to ever changing technologies or our failure to regularly upgrade existing or introduce new products or to introduce these products on schedule could cause us to not only lose our current customers but also fail to attract new customers.

The continued success of our business model is heavily dependent upon our offshore operations, and any disruption to those operations will adversely affect us.

The majority of our operations, including the development and maintenance of our web-based platform, our customer support services and medical billing activities, are performed by our highly educated workforce of approximately 3,400 employees in our Offshore Offices. Approximately 99% of our offshore employees are in our Pakistan Offices and our remaining employees are located at our smaller offshore operation center in Sri Lanka. The performance of our operations in our Pakistan Offices, and our ability to maintain our offshore offices, is an essential element of our business model, as the labor costs where our Pakistan Offices are located are substantially lower than the cost of comparable labor in India, the United States and other countries, and allows us to competitively price our products and services. Our competitive advantage will be greatly diminished and may disappear altogether if our operations in our Pakistan Offices are negatively impacted.

Pakistan and Sri Lanka have in the past experienced and could in the future continue to experience periods of political and social unrest, war and acts of terrorism. Our operations in our offshore locations may be negatively impacted by these and a number of other factors, including currency fluctuations, cost of labor and supplies, power grid and infrastructure issues, vandalism, and changes in local law, as well as laws within the United States relating to these countries. Client mandates or preferences for onshore service providers may also adversely impact our business model. Our operations in our Offshore Offices may also be affected by trade restrictions, such as tariffs or other trade controls. If we are unable to continue to leverage the skills and experience of our highly educated workforce, particularly in our Pakistan Offices, we may be unable to provide our products and services at attractive prices, and our business would be materially and negatively impacted or discontinued.

We believe that the labor costs in our Offshore Offices are approximately 11% of the cost of comparably educated and skilled workers in the U.S. If there were potential disruptions in any of these locations, they could have a negative impact on our business.

| 18 |

Our offshore operations expose us to additional business and financial risks which could adversely affect us and subject us to civil and criminal liability.

The risks and challenges associated with our operations outside the United States include laws and business practices favoring local competitors; compliance with multiple, conflicting and changing governmental laws and regulations, including employment and tax laws and regulations; and fluctuations in foreign currency exchange rates. Foreign operations subject us to numerous stringent U.S. and foreign laws, including the Foreign Corrupt Practices Act (“FCPA”), and comparable foreign laws and regulations that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. and other business entities for the purpose of obtaining or retaining business. Safeguards we implement to discourage these practices may prove to be less than effective and violations of the FCPA and other laws may result in severe criminal or civil sanctions, or other liabilities or proceedings against us, including class action lawsuits and enforcement actions from the SEC, Department of Justice and overseas regulators.

Changes in the healthcare industry could affect the demand for our services and may result in a decrease in our revenues and market share.

As the healthcare industry evolves, changes in our customer base may reduce the demand for our services, result in the termination of existing contracts, and make it more difficult to negotiate new contracts on terms that are acceptable to us. For example, the current trend toward consolidation of healthcare providers may cause our existing customer contracts to terminate as independent practices are merged into hospital systems or other healthcare organizations. Such larger healthcare organizations may have their own practice management, and EHR and RCM solutions, reducing demand for our services. If this trend continues, we cannot assure you that we will be able to continue to maintain or expand our customer base, negotiate contracts with acceptable terms, or maintain our current pricing structure, which would result in a decrease in our revenues and market share.

If providers do not purchase our products and services or delay in choosing our products or services, we may not be able to grow our business.

Our business model depends on our ability to sell our products and services. Acceptance of our products and services may require providers to adopt different behavior patterns and new methods of conducting business and exchanging information. Providers may not integrate our products and services into their workflow and may not accept our solutions and services as a replacement for traditional methods of practicing medicine. Providers may also choose to buy our competitors’ products and services instead of ours. Achieving market acceptance for our solutions and services will continue to require substantial sales and marketing efforts and the expenditure of significant financial and other resources to create awareness and demand by providers. If providers fail to broadly accept our products and services, our business, financial condition and results of operations will be adversely affected.

If the revenues of our customers decrease, or if our customers cancel or elect not to renew their contracts, our revenue will decrease.

Under most of our RCM customer contracts, we base our charges on a percentage of the revenue that our customer collects through the use of our services. Many factors may lead to decreases in customer revenue, including:

| ● | reduction of customer revenue as a result of changes to the ACA or decreased medical appointments during COVID-19; |

| ● | a rollback of the expansion of Medicaid or other governmental programs; |

| ● | reduction of customer revenue resulting from increased competition or other changes in the marketplace for physician services; |

| ● | failure of our customers to adopt or maintain effective business practices; |

| ● | actions by third-party payers of medical claims to reduce reimbursement; |

| ● | government regulations and government or other payer actions or inactions reducing or delaying reimbursement; |

| ● | interruption of customer access to our system; and |

| ● | our failure to provide services in a timely or high-quality manner. |

| 19 |

We have incurred operating losses and net losses, and we may not be able to achieve or subsequently maintain profitability in the future.

While we recognized net income of approximately $2.8 million for the year ended December 31, 2021, we incurred a net loss of $8.8 million for the year ended December 31, 2020. Our net income and net loss for the years ended December 31, 2021 and 2020, respectively, include approximately $8.9 million and $8.1 million of non-cash amortization expense of purchased intangible assets, respectively.

We may not succeed in achieving the efficiencies we anticipate from our acquisitions and possible future acquisitions, including moving sufficient labor to our offshore locations to offset increased costs resulting from these acquisitions, and we may continue to incur losses in future periods. We incur additional operating expenses as a public company and we intend to continue to increase our operating expenses as we grow our business. We also expect to continue to make investments in our proprietary technology, sales and marketing, infrastructure, facilities and other resources as we seek to grow, thereby incurring additional costs. If we are unable to generate adequate revenue growth and manage our expenses, we may continue to incur losses in the future and may not be able to achieve or maintain profitability.

As a result of our variable sales and implementation cycles, we may be unable to recognize revenue from prospective customers on a timely basis and we may not be able to offset expenditures.

The sales cycle for our services can be variable, typically ranging from two to four months from initial contact with a potential customer to contract execution, although this period can be substantially longer. During the sales cycle, we expend time and resources in an attempt to obtain a customer without recognizing revenue from that customer to offset such expenditures. Our implementation cycle is also variable, typically ranging from two to four months from contract execution to completion of implementation. Each customer’s situation is different, and unanticipated difficulties and delays may arise as a result of a failure by us or by the customer to meet our respective implementation responsibilities. During the implementation cycle, we expend substantial time, effort, and financial resources implementing our services without recognizing revenue. Even following implementation, there can be no assurance that we will recognize revenue on a timely basis or at all from our efforts. In addition, cancellation of any implementation after it has begun may involve loss to us of time, effort, and expenses invested in the canceled implementation process, and lost opportunity for implementing paying customers in that same period of time.

As a result of the Wayfair decision and changes in various states’ laws, we are required to collect sales and use taxes on certain products and services we sell in certain jurisdictions. We may be subject to liability for past sales and incur additional related costs and expenses, and our future sales may decrease.

We may lose sales or incur significant expenses should states be successful in imposing additional state sales and use taxes on our products and services. A successful assertion by one or more states that we should collect sales or other taxes on the sale of our products and services that we are currently not collecting could result in substantial tax liabilities for past sales, decrease our ability to compete with healthcare IT vendors not subject to sales and use taxes, and otherwise harm our business. Each state has different rules and regulations governing sales and use taxes, and these rules and regulations are subject to varying interpretations that may change over time. We review these rules and regulations periodically and, when we believe that our products or services are subject to sales and use taxes in a particular state, we voluntarily approach state tax authorities in order to determine how to comply with their rules and regulations. We cannot assure you that we will not be subject to sales and use taxes or related penalties for past sales in states where we believe no compliance is necessary.

If the federal government were to impose a tax on imports or services performed abroad, we might be subject to additional liabilities. At this time, there is no way to predict whether this will occur or estimate the impact on our business.