UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

CareCloud, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CareCloud, Inc.

7 Clyde Road

Somerset, NJ 08873

May 3, 2024

Dear Fellow Shareholder:

It is my pleasure to invite you to attend the Annual Meeting of Shareholders of CareCloud, Inc. (the “Company”) at 11:00 a.m., Eastern Time, on Monday, June 17, 2024 at our principal executive offices at 7 Clyde Road, Somerset, NJ 08873.

The following pages contain the formal Notice of the Annual Meeting and the Proxy Statement. If you plan to attend the Annual Meeting, please detach the Admission Ticket from your proxy card and bring it to the Annual Meeting. The proxy materials will be first sent or given to shareholders on or about May 3, 2024.

At this year’s Annual Meeting, you will be asked to vote on the proposals set forth in the Notice of Annual Meeting of Shareholders and proxy statement, which describes the formal business to be conducted at the Annual Meeting and follows this letter.

Your vote is important. Whether you plan to attend the Annual Meeting in person or not, we hope you will vote your shares as soon as possible. Please mark, sign, date, and return the accompanying card in the provided postage-paid envelope or instruct us via the Internet as to how you would like your shares voted. Instructions are on the proxy card. This will ensure representation of your shares if you are unable to attend.

| Sincerely, | |

| /s/ Norman Roth | |

| Norman Roth | |

| Interim Chief Financial Officer and Assistant Corporate Secretary |

| i |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 17, 2024

TIME

11:00 a.m., Eastern Time, on

Monday, June 17, 2024

PURPOSE

| ● | To elect to the Board of Directors (the “Board”) the following nominees presented by the Board: A. Hadi Chaudhry, John Daly, Mahmud Haq and Cameron Munter. | |

| ● | To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s 2024 Proxy Statement’s compensation tables and any related information found in such proxy statement. | |

| ● | To consider and act on such other business as may properly come before the Annual Meeting on any postponement(s) or adjustment(s) thereof. |

DOCUMENTS

This Notice is only an overview of the proxy statement and proxy card included in this mailing which is also available at https://ir.carecloud.com/sec-filings. The Notice of Internet Availability will be mailed to shareholders on or about May 3, 2024.

PLACE

The Company’s principal executive offices located at 7 Clyde Road, Somerset, NJ 08873.

RECORD DATE

Owners of shares of the Company’s Common Stock, as of the close of business on April 18, 2024, will receive notice of and be entitled to vote at the Annual Meeting and any adjournments.

VOTING

Even if you plan to attend the Annual Meeting, please mark, sign, date, and return the enclosed proxy card in the enclosed postage-paid envelope. You may revoke your proxy by filing with the Secretary of the Company a written revocation or by submitting a duly executed proxy bearing a later date. If you are present at the Annual Meeting, you may revoke your proxy and vote in person on each matter brought before the Annual Meeting. You may also vote over the Internet using the Internet address on the proxy card. To be considered, all votes must be received by midnight on June 10, 2024.

Norman Roth

Interim Chief Financial Officer and Assistant Corporate Secretary

Dated: May 3, 2024

| ii |

TABLE OF CONTENTS

| iii |

Q: When and where is the Annual Meeting?

A: The Company’s Annual Meeting of Shareholders will be held at 11:00 a.m., Eastern Time, Monday, June 17, 2024, at our principal executive offices at 7 Clyde Road, Somerset, NJ 08873.

Q: Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A: In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our Annual Report, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials, which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice of Internet Availability also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice of Internet Availability.

Q: Who is entitled to vote?

A: You are entitled to vote at the Annual Meeting if the Company’s records on April 18, 2024 (the “record date”) show that you owned the Company’s common stock, par value $0.001 (the “Common Stock”) on such date. As of April 18, 2024, there were 16,118,492 shares of Common Stock outstanding.

Q: What will I likely be voting on?

A: There are two proposals that are expected to be voted on at the Annual Meeting, which are (i) to elect to the Board of Directors the following nominees presented by the Board: A. Hadi Chaudhry, John Daly, Mahmud Haq and Cameron Munter to serve as directors and (ii) to approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s 2024 Proxy Statement’s compensation tables and any related information found in such proxy statement. As of the date of this Proxy Statement, the Company was not aware of any additional matters to be raised at the Annual Meeting.

Q: What is the Board’s recommendation?

A: The Board of Directors recommends that you vote your shares:

| − | FOR the director nominees. | |

| − | FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers. |

Q: How many votes is each share entitled to?

A: Each share of Common Stock has one vote. The enclosed proxy card shows the number of shares that you are entitled to vote.

Q: Do I need a ticket to attend the Annual Meeting?

A: Yes. Retain the top of the proxy card as your admission ticket. One ticket will permit two persons to attend. If your shares are held through a broker, contact your broker and request that the broker provide you with evidence of share ownership. This documentation, when presented at the registration desk at the Annual Meeting, will enable you to attend the Annual Meeting.

Q: How do proxies work?

A: The Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Meeting in the manner you direct. You may also abstain from voting. If you sign and return the enclosed proxy card but do not specify how to vote, we will vote your shares in accordance with our recommendations above.

| 1 |

Q: How do I vote?

A: You may:

| ● | Vote by marking, signing, dating, and returning a proxy card; | |

| ● | Vote via the Internet by following the voting instructions on the proxy card or the voting instructions provided by your broker, bank, or other holder of record. Internet voting procedures are designed to authenticate your identity, allow you to vote your shares, and confirm that your instructions have been properly recorded. If you submit your vote via the Internet, you may incur costs associated with electronic access, such as usage charges from Internet access providers and telephone companies; or | |

| ● | Vote in person by attending the Annual Meeting. We will distribute written ballots to any shareholder who wishes to vote in person at the Annual Meeting. |

If your shares are held in street name, your broker, bank, or other holder of record will include a voting instruction form with this Proxy Statement. We strongly encourage you to vote your shares by following the instructions provided on the voting instruction form. Please return your voting instruction form to your broker, bank, or other holder of record to ensure that a proxy card is voted on your behalf.

Q: Do I have to vote?

A: No. However, we strongly encourage you to vote.

Q: What does it mean if I receive more than one proxy card?

A: If you hold your shares in multiple registrations, or in both registered and street name, you will receive a proxy card for each account. Please mark, sign, date, and return each proxy card you receive. If you choose to vote by Internet, please vote each proxy card you receive.

Q: Will my shares be voted if I do not sign and return my proxy card?

A: If your shares are held in street name and you do not instruct your broker or other nominee how to vote your shares, your broker or nominee may use its discretion to vote your shares on “routine matters”. For any “non-routine matters” being considered at the Meeting, your broker or other nominee would not be able to vote on such matters.

Under the rules and interpretations of the NYSE (which by extension apply to all United States brokers, even though the Company’s Common Stock is listed on The Nasdaq Global Market), “non-routine matters” are matters that may substantially affect the rights or privileges of shareholders, such as mergers, shareholder proposals, elections of directors (even if not contested) and executive compensation, including say-on-pay advisory shareholder votes on executive compensation and say-on-frequency advisory shareholder votes on executive compensation.

The proposals in this proxy statement are expected to be considered a “non-routine matter”. Therefore, your broker or other nominee is not entitled to vote your shares on these proposals without your instructions.

Q: Can I change my vote?

A: Yes. You may revoke your proxy and change your vote before the Annual Meeting by submitting a new proxy card with a later date, by casting a new vote via the Internet, by notifying the Company’s Assistant Corporate Secretary in writing, or by voting in person at the Meeting. If you do not properly revoke your proxy, properly executed proxies will be voted as you specified in your earlier proxy.

Q: What is a quorum?

A: A quorum is the number of shares that must be present, in person or by proxy, in order for business to be transacted at the Annual Meeting. At least a majority of the outstanding shares eligible to vote must be represented at the Meeting, either in person or by proxy, in order to transact business.

| 2 |

Q: Who will tabulate the votes?

A: A representative from our Company, Norman Roth, will tabulate the votes and act as inspector of election.

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of election. The inspector will also determine whether a quorum is present at the Annual Meeting.

The shares represented by the proxy cards received, properly marked, dated, signed, and not revoked, will be voted at the Annual Meeting. If the proxy card specifies a choice with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. Any proxy card that is returned signed but not marked will be voted as recommended by the Board of Directors.

Q: How do I find out the voting results?

A: Preliminary results are typically announced at the Annual Meeting. Final voting results will be reported on a Form 8-K filed with the SEC following the Annual Meeting.

Q: How are proposals approved by the security holders?

A: In the election of directors, you may vote “For” all or some of the nominees or you may vote to “Withhold Authority” with respect to one or more of the nominees. Our directors will be elected by a plurality of the votes cast by the shares entitled to vote at the Annual Meeting so long as a quorum is present. A properly executed proxy marked “Withhold Authority” with respect to the election of one or more director nominees will not be voted with respect to the director or director nominees indicated, although it will be counted for purposes of determining whether there is a quorum.

For the advisory vote on the frequency of future say-on-pay votes, the option receiving the highest number of votes will be deemed to be the preferred frequency of our shareholders.

All other corporate governance actions will be approved by a majority of the votes cast. Although state law and our certificate of incorporation and bylaws are silent on the issue, abstentions or broker non-votes as to any matter will be included in the calculations as to the presence of a quorum, but will not be counted as votes cast in such matter in the calculation as to the needed majority vote.

Q: Who will bear the costs of this solicitation?

A: Our Board of Directors is making this solicitation on behalf of the Company, and the Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. If you choose to access the proxy materials over the Internet; however, you are responsible for Internet access charges you may incur. The solicitation of proxies or votes may be made in person. We will also reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

Q: What should I do now?

A: You should read this proxy statement carefully and promptly submit your proxy card or vote by the Internet as provided on the proxy card to ensure that your vote is counted at the Annual Meeting.

Q: How will shares in the Company’s employee benefit plans be voted?

A: If you are or were a participant in the Company’s employee benefit plans, this Proxy Statement is being used to solicit voting instructions from you with respect to shares of our stock that you own but which are held by the trustees of our benefit plans for the benefit of you and other plan participants. Shares held in our benefit plans that you are entitled to vote will be voted by the plan trustees pursuant to your instructions. Shares held in any employee benefit plan that you are entitled to vote, but do not vote, will be voted by the plan trustees in proportion to the voting instructions received for other shares. You must instruct the plan trustees to vote your shares by utilizing one of the voting methods described above.

| 3 |

Q: How do I obtain a copy of the Company’s materials related to corporate governance?

A: The Company’s Corporate Governance materials, charters of each standing Board Committee, Code of Conduct, and other materials related to our corporate governance can be found in the Corporate Governance section of the Company’s website at https://ir.carecloud.com/corporate-governance/governance-documents.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information, as of April 18, 2024, concerning:

| - | Each person or group of persons known by the Company to own beneficially more than five percent of the outstanding shares of Common Stock, based on information provided by the beneficial owner in public filings made with the Securities and Exchange Commission (“SEC”). | |

| - | Each person who has been a director or executive officer of the Company since the beginning of the last fiscal year. | |

| - | Each nominee for the Board of Directors. | |

| - | Each associate of any of the foregoing persons. |

Unless otherwise noted below, the address of each beneficial owner listed in the table is c/o CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873. Beneficial ownership is determined in accordance with the rules of the SEC, which deem a person to beneficially own any shares the person has or shares voting or dispositive power over and any additional shares obtainable within 60 days through the exercise of options, warrants or other purchase rights. Shares of common stock subject to options, warrants or other rights to purchase that are currently exercisable or are exercisable within 60 days of April 18, 2024 (including shares subject to restrictions that lapse within 60 days of the record date) are deemed outstanding for purposes of computing the percentage ownership of the person holding such shares, options, warrants or other rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, each person possesses sole voting and investment power with respect to the shares identified as beneficially owned. The percentages are based on 16,118,492 shares of Common Stock outstanding as of April 18, 2024 and 1,482,792 shares of Series B Preferred Stock outstanding as of April 18, 2024. None of the directors or named executive officers owned Series A Preferred Stock as of April 18, 2024. Each share of Common Stock has one vote.

| Name of Beneficial Owner | Common Stock Beneficially Owned | Percent of Class | Preferred Stock - Series B Beneficially Owned | Percent of Class | ||||||||||||

| Directors and Named Executive Officers | ||||||||||||||||

| Mahmud Haq, Executive Chairman | 5,034,520 | 31.2 | % | 5,480 | 0.4 | % | ||||||||||

| A. Hadi Chaudhry, CEO & President | 114,892 | 0.7 | % | - | - | |||||||||||

| Norman Roth, Interim CFO | 96,700 | 0.6 | % | - | - | |||||||||||

| Anne M. Busquet | 238,888 | 1.5 | % | - | - | |||||||||||

| John N. Daly | 64,250 | 0.4 | % | - | - | |||||||||||

| Bill Korn | 160,383 | 1.0 | % | 10,800 | 0.7 | % | ||||||||||

| Cameron P. Munter | 176,500 | 1.1 | % | - | - | |||||||||||

| Lawrence S. Sharnak | 71,500 | 0.4 | % | - | - | |||||||||||

| All current directors and executive officers as a group (8 persons) | 5,957,633 | 36.9 | % | 16,280 | 1.1 | % | ||||||||||

| 4 |

Role and Composition of the Board of Directors

The Company’s Board of Directors believes that good corporate governance principles and practices provide a strong framework to assist the Board in fulfilling its responsibilities to shareholders. The Board recognizes the interests of the Company’s shareholders, employees, customers, suppliers, consumers, creditors, and the communities in which it operates, who are all essential to the Company’s success. Accordingly, the Board has adopted corporate governance principles relating to its role, composition, structure, and functions. The Board periodically reviews the principles and other corporate governance matters.

The following reflects, as of December 31, 2023 and December 31, 2022, the gender, racial and ethnic diversity of our Board of Directors:

| ● | 14% of the Directors are women. | |

| ● | 29% of the Directors are racially/ethnically diverse. | |

| ● | 43% of the Directors are gender/ethnically diverse. |

As of December 31, 2023

| Gender Identity: | Female | Male | Non-Binary | Did not disclose | ||||

| Board of Directors | 1 | 6 | - | - | ||||

| Demographic Background: | ||||||||

| African American or Black | - | - | - | - | ||||

| Alaskan Native or American Indian | - | - | - | - | ||||

| Asian | - | 2 | - | - | ||||

| Hispanic or Latinx | - | - | - | - | ||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||

| White | 1 | 4 | - | - | ||||

| Two or More Races or Ethnicities | - | - | - | - | ||||

| LGBTQ+ | - | |||||||

| Did Not Disclose Demographic Background | - | |||||||

As of December 31, 2022

| Gender Identity: | Female | Male | Non-Binary | Did not disclose | ||||

| Board of Directors | 1 | 5 | - | 1 | ||||

| Demographic Background: | ||||||||

| African American or Black | - | - | - | - | ||||

| Alaskan Native or American Indian | - | - | - | - | ||||

| Asian | - | 2 | - | - | ||||

| Hispanic or Latinx | - | - | - | - | ||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||

| White | 1 | 3 | - | - | ||||

| Two or More Races or Ethnicities | - | - | - | - | ||||

| LGBTQ+ | - | |||||||

| Did Not Disclose Demographic Background | 1 | |||||||

| 5 |

Role of the Board and Management and Role in Risk Oversight

The Company’s business is conducted by its employees, managers, and officers under the direction of the Chief Executive Officer (“CEO”) and the oversight of the Board. The Board of Directors is elected by the shareholders to oversee management and to ensure that the long-term interests of the shareholders are being served. Directors are expected to fulfill duties of care and loyalty and to act with integrity as they actively conduct Board matters. Different persons serve in the positions of CEO and Executive Chairman.

As part of its general oversight function, the Board actively reviews and discusses reports by management on the performance of the Company, its strategy, goals, financial objectives, and prospects, as well as issues and risks facing the Company. The opinions of the independent Compensation Committee Board members are solicited with respect to the selection, evaluation, and determination of compensation and succession planning for the Executive Chairman, CEO and senior executive officers who report directly to the CEO. The Board oversees processes designed to maintain the quality of the Company, including the integrity of the financial statements, the integrity of compliance with laws and ethics, and the integrity of relationships with stakeholders, including shareholders, employees, customers, suppliers, consumers, and the communities in which the Company operates.

The Board administers its risk oversight function directly and through the Board committees. Management regularly reports to the Board and/or the relevant committee regarding identified or potential risks. The general areas of material risk to the Company include strategic, operational, financial, regulatory, and legal risks. The Board regularly reviews our Company’s strategies and attendant risks, and provides advice and guidance on strategies to manage these risks while attaining long and short-term goals.

Operational risks, financial risks, including internal controls and credit risk associated with our customers, and risks associated with data privacy and security, as well as overall economic risks, are within the purview of the Audit Committee. The Audit Committee’s review is accompanied by regular reports from management and assessments from our internal auditors. In assessing legal or regulatory risks, the Board and the Audit Committee are advised by management, legal counsel, and experts, as appropriate.

Appointed by the Board as a subcommittee to the Audit Committee, the Cybersecurity Subcommittee will assist the Audit Committee in overseeing the Corporation’s information technology systems to identify, assess and manage the risks related to cybersecurity.

The Compensation Committee is responsible for overseeing the management of risks associated with executive and employee compensation plans and retention, with the goal to ensure that the Company’s compensation programs remain consistent with our shareholders’ interests that such programs do not encourage excessive risk-taking and that such programs are designed to retain valued executives and employees.

Board Membership Qualifications

The Board has the responsibility for nominating director candidates to shareholders and filling vacancies. The Nominating and Corporate Governance Committee is responsible for recommending candidates to the Board, as well as recommending the selection criteria used in seeking nominees for election to the Board. The Board has adopted the following director nominee selection criteria. Nominees should possess the highest personal and professional ethics, integrity, and values, and be committed to representing the long-term interests of all shareholders. Nominees should be selected on the basis of their business and professional experience and qualifications, public service, diversity of background (including diversity of gender, race, ethnic or geographic origin, age and experience) and availability to devote sufficient time to the Board and the needs of the Company in light of the qualifications of the other directors or nominees. A diverse Board is likely to be a well-balanced Board with varying perspectives and a breadth of experience that will positively contribute to robust discussion at Board meetings. Candidates should be persons who have demonstrated leadership in multinational companies or government, finance or accounting, higher education or other fields, or who are able to provide the Company with relevant expertise, industry knowledge or marketing acumen. Nominees should also represent all shareholders rather than special interest groups or any group of shareholders. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee also considers the director’s past attendance at meetings and participation in and contribution to the activities of the Board. The Nominating and Corporate Governance Committee may use the services of an executive search firm to assist the Company in identifying potential nominees and to participate in the evaluation of candidates for Board membership. The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders. Shareholders may suggest nominees for consideration by submitting names of nominees and supporting information to the Assistant Corporate Secretary of the Company. The Nominating and Corporate Governance Committee evaluates all candidates for director in the same manner regardless of the source of the recommendation.

| 6 |

Size of the Board

The Company’s By-Laws establish that the Board shall determine the number of directors from time to time so long as the number so determined shall not be less than three. The Board periodically reviews the appropriate size of the Board, which is presently set at seven Board members by resolution of the Board of Directors.

Executive Chairman and CEO

The Executive Chairman and the CEO are selected by the Board. The Board determines whether the roles of Executive Chairman and CEO should be separate or combined based upon its judgment as to the most appropriate structure for the Company at a given point in time. Mahmud Haq serves as Executive Chairman and A. Hadi Chaudhry serves as CEO.

Ethics and Conflicts of Interest

The Board expects its directors, as well as the Company’s officers and employees, to act ethically at all times and to acknowledge their adherence to the policies comprising the Company’s Code of Conduct. The Board will not permit any waiver of any ethics policy for any director or executive officer. The Board will resolve any conflict of interest question involving a director, the CEO, or a member of the Office of the Executive Chairman, and the CEO will resolve any conflict of interest issue involving any other officer of the Company. The Code of Conduct is available at https://ir.carecloud.com/corporate-governance/governance-documents.

Attendance at the 2023 Annual Meeting

In 2023, two of the directors then in office attended the 2023 Annual Meeting.

BOARD COMMITTEES

Number and Responsibilities of Committees

The current three committees of the Board are Audit, Compensation, and Nominating and Corporate Governance. The Cybersecurity subcommittee reports to the Audit committee. The membership of the committees is required to consist entirely of independent directors, based on the Nasdaq requirements. The Board may form new committees, disband an existing committee, and delegate additional responsibilities to a committee. The responsibilities of the committees and subcommittee are set forth in written charters, which are reviewed periodically by the committees, the Nominating and Corporate Governance Committee, and the Board, and are available on the Company’s website at https://ir.carecloud.com/corporate-governance/governance-documents.

Committee and Subcommittee Meetings

The chair of each committee and subcommittee in consultation with committee members and in compliance with the committee’s and subcommittee’s charter requirements, determines the frequency of meetings and develops meeting agendas. The full Board is apprised of matters addressed by the committees in their meetings. During 2023, the Audit Committee held four meetings, the Compensation Committee held four meetings, the Nominating and Corporate Governance Committee held four meetings and the Cybersecurity subcommittee held two meetings.

BOARD OPERATIONS

Board Meetings

Regular meetings of the Board are held at least four times per year. The Board may hold additional meetings, including by teleconference or other electronic means, as needed, to discharge its responsibilities. The Chairman of the Board, in consultation with other Board members, establishes the agenda for each Board meeting. Each Board member may suggest items for inclusion on the agenda.

| 7 |

During 2023, the Board held seven meetings and acted by written/electronic consent five times. Each director attended at least 75% of all Board of Directors and applicable committee and subcommittee meetings.

Board Materials

Information and data that is important to the business to be considered at a Board or committee meeting are distributed in advance of the meeting, to the extent possible.

Management Evaluation, Succession, and Compensation

The performance of the Executive Chairman and CEO is evaluated annually by the Compensation Committee, in consultation with the full Board, based upon objective criteria, including the performance of the business and the accomplishment of goals and strategic objectives. This committee also makes recommendations to the Board with respect to CEO succession. The CEO reviews management succession planning and development with the full Board of Directors on an annual basis.

The Compensation Committee reviews and approves annually all compensation for the CEO and other executive officers, including (a) annual base salary; (b) incentive compensation, whether cash or equity-based, including specific amounts; (c) equity awards; (d) employment agreements, severance arrangements, and change in control agreements/provisions; and (e) any other benefits, compensation or arrangements. In connection therewith, the Compensation Committee periodically reviews and advises the Board concerning regional, industry-wide and other relevant compensation practices and trends in order to assess the adequacy and competitiveness of the Company’s compensation programs for the CEO and other named executive officers relative to comparable companies in the Company’s industry and geographic locations.

Board Compensation

The Compensation Committee is responsible for recommending any changes in Board compensation. In discharging this duty, the committee is guided by the following considerations: compensation should fairly pay directors for work required for a company of CareCloud’s size and scope; compensation should align directors’ interests with the long-term interests of shareholders; and the structure of compensation should be transparent and understandable. Non-employee directors receive a monthly retainer plus restricted stock units, with no additional fees for meeting attendance. The chairperson of the Audit Committee receives an additional retainer for serving in that capacity.

Board Access to Management and Independent Advisors

Members of the Board have free access to the employees of the Company, and Board committees have the authority to retain such outside advisors as they determine appropriate to assist in the performance of their functions. Additionally, members of the Board may periodically visit Company facilities.

Approval of Goals and Strategic and Financial Objectives

The overall strategy of the Company is reviewed periodically at Board meetings.

Communication with Management and Directors

The response to any shareholder proposal is the responsibility of management subject to oversight by the appropriate Board committee. The Board is apprised of shareholder proposals and the Company’s response to such proposals.

Shareholders and other interested parties may contact any of the Company’s directors, including the presiding director or the non-management directors as a group, by writing a letter to the Board c/o the Assistant Corporate Secretary of the Company at 7 Clyde Road, Somerset, NJ 08873. The Assistant Corporate Secretary will forward communications directly to the presiding director, unless a different director is specified.

Disclosure and Review of Corporate Governance Principles

The Company’s Corporate Governance Principles and all Board committee charters are available on the Company’s website at https://ir.carecloud.com/corporate-governance/governance-documents and are also available in print to any shareholder upon request. The Nominating and Corporate Governance Committee reviews these Corporate Governance Principles periodically, and reports the results of this review to the full Board.

| 8 |

Policies on Business Ethics and Conduct

All Company employees and directors, including the Executive Chairman, the Chief Executive Officer, the Chief Financial Officer, and the Principal Accounting Officer, are required to abide by the Company’s Code of Conduct to ensure that the Company’s business is conducted in a consistently legal and ethical manner. The Code of Conduct forms the foundation of a comprehensive program that requires compliance with all corporate policies and procedures and seeks to foster an open relationship among colleagues that contributes to good business conduct and an abiding belief in the integrity of our employees. The Company’s policies and procedures cover all areas of professional conduct, including employment policies, conflicts of interest, intellectual property, and the protection of confidential information, as well as strict adherence to all laws and regulations applicable to the conduct of the Company’s business.

Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Conduct.

The full text of the Code of Conduct is published on the Company’s website at https://ir.carecloud.com/corporate-governance/governance-documents, and is available in print to any shareholder upon request.

Director Independence

Our Board has considered the relationships of all directors with us and the independence of each director, and determined that Ms. Anne Busquet and Messrs. John N. Daly, Cameron P. Munter and Lawrence S. Sharnak, do not have any relationship which would interfere with the exercise of independent judgment in carrying out his or her responsibility as a director and that each of them qualifies as an independent director under the applicable rules of Nasdaq.

Related Person Transaction Policy

The Board recognizes that related person transactions present a heightened risk of conflicts of interest. The Related Person Transaction Policy of the Board ensures that the Company’s transactions with certain persons are not inconsistent with the best interests of the Company. A “Related Person Transaction” is a transaction involving the Company in an amount exceeding $54,500 in which a Related Person has a direct or indirect material interest. A Related Person includes the executive officers, directors, and five percent or more shareholders of the Company, and any immediate family member of such a person. Related Person Transactions are reviewed as they arise and are brought to the attention of the General Counsel and the Audit Committee for its approval, ratification, revision, or rejection in consideration of all of the relevant facts and circumstances. For any Related Person Transaction to continue, the Audit Committee must approve or ratify such transaction, which the Audit Committee will do if it determines that such transaction is in the Company’s best interests. The Audit Committee also reviews materials prepared by the General Counsel or the Chief Financial Officer to determine whether any Related Person Transactions have occurred that have not been reported. The Company maintains a written policy regarding Related Person Transactions.

Related Person Transactions

The Company had sales to a related party, a physician who is the wife of the Executive Chairman. Revenues from this customer were approximately $125,000 and $58,000 for the years ended December 31, 2023 and 2022, respectively. As of December 31, 2023 and 2022, the accounts receivable balance due from this customer was approximately $18,000 and $10,000, respectively, and is included in accounts receivable - net in the Company’s consolidated balance sheets.

| 9 |

The Company leases its corporate offices in New Jersey, its temporary housing for its foreign visitors, a storage facility, its backup operations center in Bagh, Pakistan and an apartment for temporary housing in Dubai, the UAE, from the Executive Chairman. The related party rent expense for the years ended December 31, 2023 and 2022 was approximately $256,000 and $198,000, respectively, and is included in direct operating costs and general and administrative expense in the consolidated statements of operations. During the years ended December 31, 2023 and 2022, the Company spent approximately $1.8 million and $941,000, respectively, to upgrade the related party leased facilities. During the years ended December 31, 2023 and 2022, the Company temporarily advanced the Executive Chairman approximately $330,000 and $42,000, respectively, to purchase vacant land surrounding the Bagh facility for the sole use and benefit of the Company in order to expedite the purchase on the Company’s behalf as only individuals with citizenship in Kashmir are allowed to purchase land in this region. All advanced amounts were repaid shortly after the advance was made. Current assets-related party in the consolidated balance sheets includes security deposits related to the leases of the Company’s corporate offices in the amount of approximately $16,000 for both the years ended December 31, 2023 and 2022. The Company also leases two facilities used for temporary housing from a management employee for approximately $6,200 per month.

Included in the ROU asset in the Company’s consolidated balance sheet at December 31, 2023 is approximately $331,000 applicable to the related party leases. Included in the current and non-current operating lease liability at December 31, 2023 is approximately $182,000 and $142,000, respectively, applicable to the related party leases.

Included in the ROU asset in the Company’s consolidated balance sheet at December 31, 2022 is approximately $467,000 applicable to the related party leases. Included in the current and non-current operating lease liability at December 31, 2022 is approximately $158,000 and $301,000, respectively, applicable to the related party leases.

During June 2022, the Company entered into a one-year consulting agreement with an entity owned and controlled by one of its former non-independent directors whereby that director received 10,000 shares of the Company’s 8.75% Series B Cumulative Redeemable Perpetual Preferred Stock (“Series B Preferred Stock”) in exchange for assisting the Company to identify and acquire additional companies, including performing due diligence. In addition, the Company may make additional payments under the agreement for any successful acquisitions by the Company based on the purchase price of the transaction. No such additional payments were made in 2022. During February 2023, the agreement was amended and extended through December 2024 whereby the former director received 14,000 shares of Series B Preferred Stock in February 2023 and received an additional 14,000 shares in January 2024. All of the payments made were expensed during the year ended December 31, 2023. The amortization is recorded as stock compensation in general and administrative expense in the consolidated statement of operations. All such shares of the Series B Preferred Stock were issued in accordance with the Company’s Amended and Restated 2014 Equity Incentive Plan. In addition to the extension of the consulting agreement, the amendment provides that any transaction fees due will be offset against the last two above payments before any amounts are due to that former director. There were no transaction fees through December 31, 2023.

During 2020, a New Jersey corporation, talkMD Clinicians, PA (“talkMD”), was formed by the wife of the Executive Chairman, who is a licensed physician, to provide telehealth services. talkMD was determined to be a variable interest entity (“VIE”) for financial reporting purposes because the entity will be controlled by the Company. As of December 31, 2023, talkMD had not yet commenced operations. Cumulatively, the Company has paid approximately $5,000 on behalf of talkMD for income taxes.

Board of Directors, Committees and Subcommittees of the Board

Fiscal Year 2023

| Name | Board | Compensation | Audit | Governance | Cybersecurity | |||||

| Mahmud Haq | x* | |||||||||

| A. Hadi Chaudhry | x | x | ||||||||

| Anne M. Busquet | x | x* | ||||||||

| John N. Daly | x | x* | x | |||||||

| Bill Korn | x | |||||||||

| Cameron P. Munter | x | x | x* | |||||||

| Lawrence S. Sharnak | x | x | x | x* | ||||||

| x Member | ||||||||||

| * Chairperson |

| 10 |

Executive Officers and Directors

The following table sets forth information as of December 31, 2023 regarding our directors and executive officers.

| Name | Age | Position(s) | ||

| Mahmud Haq | 64 | Executive Chairman | ||

| A. Hadi Chaudhry | 47 | Chief Executive Officer, President and Director | ||

| Anne M. Busquet | 73 | Director | ||

| John N. Daly | 86 | Director | ||

| Nathalie Garcia | 35 | General Counsel and Corporate Secretary | ||

| Bill Korn | 66 | Director | ||

| Cameron P. Munter | 69 | Director | ||

| Norman Roth | 68 | Corporate Controller | ||

| Lawrence S. Sharnak | 70 | Director | ||

| Lawrence Steenvoorden | 53 | Chief Financial Officer |

Mahmud Haq is our founder, and served as our Chief Executive Officer and Chairman of the Board since our inception in 2001 through 2017. He currently serves as our Executive Chairman, which he became in January 2018. Prior to founding CareCloud, Mr. Haq served as the Chief Executive Officer and President of Compass International Services Corporation from 1997 to 1999. During that time, Mr. Haq also served on its Board of Directors. From 1985 to 1996, Mr. Haq held various senior executive positions at American Express, including Vice President ̵ Risk Management of Global Collections for the Travel Related Services division (1994-1996). Mr. Haq received a Bachelor of Science in Aviation Management from Bridgewater State College and holds an M.B.A. from Clark University with a concentration in Finance.

A. Hadi Chaudhry is currently our President and Chief Executive Officer. Mr. Chaudhry became President in January 2018 and Chief Executive Officer in March 2021. Effective April 11, 2019, Mr. Chaudhry was appointed as the seventh member of our Board of Directors. Mr. Chaudhry joined CareCloud in October 2002 as manager of IT, and later served as general manager, chief information officer and VP of global operations. Mr. Chaudhry has extensive healthcare IT experience, and served in various roles in the banking and IT sector prior to joining CareCloud. Mr. Chaudhry has a Bachelor of Science in Mathematics and Statistics and holds numerous information technology certifications.

Anne M. Busquet joined CareCloud’s Board of Directors in July 2014 and is the Chairperson of our Audit Committee. Ms. Busquet is presently the President of AMB Advisors, and has over three decades of executive business experience with American Express and Interactive Corp (IAC). She has led several successful businesses and served on various boards, including intercontinental Hotels Group (IHG) and Blyth, Inc. Currently, Ms. Busquet serves on the Board of Pitney Bowes and Elior Group and is also a Trustee on the Board of Overseers for Columbia University, Business School and the French Institute Alliance Francaise. Ms. Busquet graduated from Cornell University and received her MBA from Columbia University.

John N. Daly has served as a member of our Board of Directors since December 2013, and is the Chairman of our Compensation Committee and a member of our Audit Committee. Since May 2007, Mr. Daly has served as the President of IMMS, LLC, a third party marketer of investment management firms. Previously, Mr. Daly held other management positions in the financial services industry, including during his 23 years at E.F. Hutton & Co. from 1960 to 1983, where at various times he ran the Syndicate Department, the Commodities Division and the Asset Management Division. He later joined Salomon Brothers, both at the New York and London offices, where he headed the Private Client Division and International Equity Capital Markets. Mr. Daly also served as the Senior Managed Accounts Specialist at Prudential Investments from 2002-2005. Mr. Daly graduated from Yale University and completed the Harvard Business School Advanced Management Program in 1979.

Nathalie Garcia served as CareCloud’s General Counsel, Chief Compliance Officer and Corporate Secretary through March 2024. In these roles, she supported CareCloud in overseeing the Company’s compliance, regulatory and legal affairs. Ms. Garcia joined CareCloud in early 2020 following the Company’s acquisition of CareCloud Corp., where she began working in 2017 and served as Associate Corporate Counsel at the time of the acquisition. Ms. Garcia was named General Counsel and Corporate Secretary in October 2023 and Chief Compliance Officer in September 2020. Prior to joining CareCloud, she worked in human resources and clerked in various areas of law including intellectual property, privacy, technology and the California Innocence Project. She is licensed to practice law in the State of Florida and California. Ms. Garcia received her Juris Doctor degree from California Western School of Law in San Diego, California and is Certified in Healthcare Compliance (“CHC”) by the Compliance Certification Board.

| 11 |

Bill Korn has served as a member of our Board of Directors since October 2023. Prior to becoming a director, Mr. Korn served as our Chief Financial Officer since July 2013, became Chief Strategy Officer in May 2023 and retired in October 2023. Prior to joining CareCloud, Mr. Korn served as the Chief Financial Officer for six other early-stage technology businesses. From January 2013 until he joined us, Mr. Korn served as the Chief Financial Officer of SnapOne, Inc., a developer of cloud-based applications for mobile devices, and from June 2012 until December 2012, Mr. Korn performed private advisory work. Prior to that, from August 2002 to June 2012, Mr. Korn was the Chief Financial Officer of Antenna Software, Inc. Earlier in his career, Mr. Korn spent ten years with IBM, where he served on the senior management team that created IBM’s services strategy in the 1990s. Currently, Mr. Korn serves on the Board of Jerash Holdings (US), Inc. (Nasdaq: JRSH), where he is Chairman of the Audit Committee. Mr. Korn received his Bachelor of Arts in Economics magna cum laude from Harvard College and his Master of Business Administration from Harvard Business School.

Cameron P. Munter has served as a member of our Board of Directors since June 2013, and is the Chairman of our Nominating and Governance Committee and a member of our Compensation Committee. Mr. Munter served as the U.S. Ambassador to Pakistan from October 2010 through July 2012 and as President and CEO of the EastWest Institute, an international, non-partisan organization through June 2019. Prior to these appointments, Mr. Munter held a variety of high-profile diplomatic positions in Iraq and also served as U.S. Ambassador to Serbia from March 2007 to March 2009. Mr. Munter received his Bachelor of Arts, magna cum laude, from Cornell University and doctoral degree in Modern European History from the Johns Hopkins University. He is a senior fellow of the CEVRO Institute in Prague and a non-resident senior fellow of the Atlantic Council in Washington.

Norman Roth was our Controller and Principal Accounting Officer as of December 31, 2023. During January 2024, Mr. Roth began also serving as the interim Chief Financial Officer. Mr. Roth joined CareCloud as our Controller and Principal Accounting Officer in September 2014. Prior to joining CareCloud, Mr. Roth worked as a forensic accountant since 2003 primarily in the accounting malpractice area. From 1991 through 2002, Mr. Roth served as the Director of External Reporting, Treasury and Tax and later as Business Manager of WWOR-TV. Mr. Roth began his career at Ernst & Young LLP in 1977 and left as a senior manager after 13 years of service. Mr. Roth received his Bachelor of Arts degree summa cum laude from Rutgers College and his Master of Business Administration -Taxation from Fairleigh Dickinson University. Mr. Roth is a certified public accountant and a certified fraud examiner.

Lawrence Sharnak joined CareCloud’s Board of Directors in April of 2020. Before joining CareCloud, Mr. Sharnak served at American Express for more than 30 years where he led in a variety of senior leadership roles. While working at American Express, Mr. Sharnak was also the founding sponsor of several employee networks including the Asian Network (ASA), the Professional Orientation and Development Program (P.O.D), and the Consumer Card Diversity Team. Currently, Mr. Sharnak is on the Board of Advisors for Cinch Board Services and he previously held board seats at Teach for America New Jersey, A+ for Kids, Consultants to Go, and Boca Grove. Mr. Sharnak received his BBA degree from the University of Massachusetts and his MBA from Babson College.

Lawrence Steenvoorden was our Chief Financial Officer as of December 31, 2023 but left the Company in January 2024. Mr. Steenvoorden joined CareCloud as our Chief Financial Officer in July 2023. Prior to joining CareCloud, Mr. Steenvoorden served as the Chief Financial Officer and Executive Vice President of Chembio Diagnostics, Inc. from January 2022 until he joined the Company. Prior to that, from December 2017 to December 2021, Mr. Steenvoorden served as Senior Director, Private Equity CFO Services, Financial Accounting and Advisory for Accordion Partners. From March 2016 to November 2017, Mr. Steenvoorden served as Chief Financial and Accounting Officer of Onyx Renewable Partners, LP. From January 2012 to February 2016, Mr. Steenvoorden served as Global Controller and Vice President, Business Planning and Controlling for Siemens Healthcare Diagnostics. From 1992 to 2011, Mr. Steenvoorden served in various controller, director and assurance roles with several companies. Mr. Steenvoorden received his Bachelor of Science in Accounting from the University of Delaware and his Master of Business Administration in Finance from Rider University.

Committee Duties and Responsibilities

Audit Committee

| ● | Oversees management’s establishment and maintenance of processes to provide for the reliability and integrity of the accounting policies, financial statements, and financial reporting and disclosure practices of the Company. |

| 12 |

| ● | Oversees management’s establishment and maintenance of processes to provide for an adequate system of internal control over financial reporting at the Company and assists with the oversight by the Board of Directors and the Corporate Governance Committee of the Company’s compliance with applicable laws and regulations. |

| ● | Oversees management’s establishment and maintenance of processes to provide for compliance with the Company’s financial policies. |

| ● | Oversees the independence of the independent registered public accounting firm and the qualifications and effectiveness of the independent registered public accounting firm. |

| ● | Prepares the report of the Audit Committee for inclusion in the Company’s annual proxy statement in accordance with applicable rules and regulations. |

| ● | Appoints, retains, and reviews the performance of the independent registered public accounting firm. |

| ● | Evaluates the Committee’s performance annually. |

| ● | Oversees the Cybersecurity Subcommittee: |

| ● | Reviews with management the status of information technology systems. | |

| ● | Oversees the global data privacy and security regulations compliance and requirements applicable. | |

| ● | Reviews incident response plan and program. | |

| ● | Oversees the appointment and retention of third-party cybersecurity solutions. | |

| ● | Periodic reviews of ISMS. | |

| ● | Reviews insurance coverage. | |

| ● | Conducts annual performance evaluations. |

Compensation Committee

| ● | Makes recommendations to the Board with respect to the structure of overall incentive compensation and equity-based plans applicable to executive officers or other employees and administers such plans. |

| ● | Selects and retains outside consultants to review and recommend appropriate types and levels of executive compensation, with the sole authority to approve consultant fees and other retention terms. Terminates such consultants as necessary. |

| ● | Prepares the report of the Compensation Committee for inclusion in the Company’s proxy statement in accordance with applicable rules and regulations. |

| ● | Evaluates the Committee’s performance annually. |

Nominating and Corporate Governance Committee

| ● | Monitors compliance with the Company’s Global Code of Conduct and all applicable laws and regulations. |

| ● | Notifies the Audit Committee of any matters regarding accounting, internal control, or audit matters of which the Committee has become aware as a result of monitoring the Company’s compliance efforts. |

| ● | Identifies qualified candidates to serve on the Board, including candidates recommended by shareholders, and reviews Board candidate qualifications, selection criteria, and any potential conflicts with the Company’s interests. |

Director Compensation Table (Fiscal Year 2023)

The following table sets forth the compensation paid to the non-executive directors of the Company in fiscal year 2023:

| Name | Fees Earned or Paid in Cash | Stock Awards (1)(2) | Total | |||||||||

| Anne M. Busquet | $ | 58,000 | $ | 51,913 | $ | 109,913 | ||||||

| John N. Daly | 48,000 | 51,913 | 99,913 | |||||||||

| Bill Korn | 12,000 | - | 12,000 | |||||||||

| Cameron P. Munter | 48,000 | 51,913 | 99,913 | |||||||||

| Lawrence S. Sharnak | 48,000 | 51,913 | 99,913 | |||||||||

| (1) | During the third quarter of 2023, the outside Board members were awarded 30,000 shares each of restricted stock units that vest in 25% increments over the next two years beginning in February 2024. Those amounts are not included in the above table as vesting did not begin until February 2024. The stock awards received by the Board above represent RSUs awards that vested in 2023. | |

| (2) | As of December 31, 2023, there were 27,500 restricted stock units outstanding for Ms. Busquet and Messrs. Daly, Munter and Sharnak and 22,500 for Mr. Korn. |

| 13 |

Summary Executive Compensation Table

The following table is a summary of certain information concerning the compensation earned by our Named Executive Officers for fiscal years 2023 and 2022:

| Name and Principal Position | Salary (1) | Bonuses (2) | Stock Awards (3) | All Other Compensation (4)(5)(6)(7) | Total | |||||||||||||||

| 2023 | ||||||||||||||||||||

| Mahmud Haq, Executive Chairman | $ | 300,000 | $ | 300,960 | $ | 24,075 | $ | 22,697 | $ | 647,732 | ||||||||||

| A. Hadi Chaudhry, CEO & President | 300,000 | 300,960 | 24,075 | 9,000 | 634,035 | |||||||||||||||

| Bill Korn, CFO | 201,923 | 436,000 | 24,075 | 9,900 | 671,898 | |||||||||||||||

| 2022 | ||||||||||||||||||||

| Mahmud Haq, Executive Chairman | $ | 300,000 | $ | 306,000 | $ | 68,925 | $ | 21,915 | $ | 696,840 | ||||||||||

| A. Hadi Chaudhry, CEO & President | 300,000 | 306,000 | 68,925 | 9,000 | 683,925 | |||||||||||||||

| Bill Korn, CFO | 250,000 | 255,000 | 68,925 | 9,150 | 583,075 | |||||||||||||||

| (1) | Includes amounts contributed by the Named Executive Officers to our 401(k) plan. | |

| (2) | In February 2023 and 2022, the Compensation Committee of the Board of Directors awarded bonuses to Messrs. Haq, Chaudhry and Korn on achieving specified operating results for 2022 and 2021, respectively. The shares are valued at their fair value as of the vesting date. In February 2022, Messrs. Haq and Chaudhry were awarded 12,000 preferred restricted stock units each and Mr. Korn was awarded 10,000 preferred restricted stock units to vest in 2023 based on the achievement of specified performance targets for 2022. These shares vested in 2023. In February 2023, Messrs. Haq and Chaudhry were awarded 12,000 preferred restricted stock units each to vest in 2024 based on the achievement of specified performance targets for 2023. These shares were not issued. Also in February 2023, Mr. Korn was awarded 10,000 preferred restricted stock units which vested in October 2023 when he retired. | |

| (3) | The stock awards reflected above represent common stock restricted stock units that vested in 2023 and 2022 that were previously awarded. The stock awards are valued at their fair value as of the vesting date. | |

| (4) | In March 2021, the Compensation Committee of the Board of Directors awarded 30,000 common restricted stock units each to Messrs. Haq, Chaudhry and Korn which vested over a two-year period at six month intervals. | |

| (5) | Does not include perquisites and other personal benefits, the aggregate amount of which with respect to each of the Named Executive Officers does not exceed $10,000 reported for the fiscal year presented. | |

| (6) | Includes our matching contribution to the 401(k) plan equal to 50% match on the first 6% of the employee’s compensation which is available to all employees who participate in the plan. | |

| (7) | Excludes group life insurance, health care insurance, long-term disability insurance and similar benefits provided to all employees that do not discriminate in scope, terms or operations in favor of the Named Executive Officers. |

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation and certain financial performance of our Company for each of the last two completed calendar years. In determining the “compensation actually paid” to our Named Executive Officers (“NEOs”), we are required to make various adjustments to amounts that have previously been reported in the Summary Compensation Table in previous years, as the SEC’s calculation method for this section differs from those required in the Summary Compensation Table. The disclosure included in this section is prescribed by SEC rules and does not necessarily align with how the Company or the Compensation Committee view the link between the Company’s performance and its Principal Executive Officer (“PEO”) and NEOs pay.

| 14 |

Pay Versus Performance Table

The table below presents information on the compensation of our PEO and our other NEOs in comparison to certain performance metrics for 2023, 2022 and 2021. The metrics are not those that the Compensation Committee uses when setting executive compensation. The use of the term “compensation actually paid” (“CAP”) is required by the SEC’s rules. Neither CAP nor the total amount reported in the Summary Compensation Table (“SCT”) reflect the amount of compensation actually paid, earned or received during the applicable year. Per SEC rules, CAP was calculated by adjusting the SCT total values for the applicable year as described in the footnotes to the table.

| Summary Compensation Table Total for PEOs (1) (2) | Compensation Actually Paid to PEOs (3) | Average Summary Compensation Table Total for Non-PEO | Average Compensation Actually Paid to Non-PEO | Value of Initial Fixed $100 Investment Based on Total Shareholder | Net (Loss) Income (7) | |||||||||||||||||||||||||||

| Year | PEO 1 | PEO 2 | PEO 1 | PEO 2 | NEOs (4) | NEOs (5) | Return (6) | ($000’s) | ||||||||||||||||||||||||

| 2023 | $ | - | $ | 634,035 | $ | - | $ | 391,680 | $ | 659,815 | $ | 403,250 | $ | 17 | $ | (48,674 | ) | |||||||||||||||

| 2022 | - | 683,925 | - | 516,120 | 639,958 | 476,043 | 31 | 5,432 | ||||||||||||||||||||||||

| 2021 | 472,905 | 344,786 | 87,360 | 772,846 | 557,620 | 561,662 | 70 | 2,836 | ||||||||||||||||||||||||

| (1) | Stephen Snyder (“PEO 1”) served as our PEO through March 29, 2021, at which time A. Hadi Chaudhry (“PEO 2”) became the PEO and served for the remainder of the year 2021 and for the full years 2022 and 2023. | |

| (2) | Amounts in this column represent the “Total” column set forth in the SCT on page 13. See the footnotes to the SCT for further detail regarding the amounts in these columns. | |

| (3) | The dollar amounts reported in these columns represent the amounts of “compensation actually paid.” The amounts are computed in accordance with Item 402(v) of Regulation S-K by deducting and adding the following amounts from the “Total” column of the SCT (pursuant to SEC rules, fair value at each measurement date is computed in a manner consistent with the fair value methodology used to account for share-based payments in our consolidated financial statements under GAAP). |

The following table reflects the adjustments made to SCT total compensation to compute CAP for the position of PEO and average CAP for our other NEOs.

| PEO 1 | PEO 2 | |||||||||||||||||||||||||||||||||||||||

| Year | SCT Total | Equity Deductions From SCT Total (a) | CAP of Equity Vesting During FY (b) | CAP of Unvested Equity at FYE (c) | Compensation Actually Paid | SCT Total | Equity Deductions From SCT Total | CAP of Equity Vesting During FY (b) | CAP of Unvested Equity at FYE (c) | Compensation Actually Paid | ||||||||||||||||||||||||||||||

| 2023 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 634,035 | $ | (325,035 | ) | $ | 4,320 | $ | 78,360 | $ | 391,680 | |||||||||||||||||||

| 2022 | - | - | - | - | - | 683,925 | (374,925 | ) | (66,195 | ) | 273,315 | 516,120 | ||||||||||||||||||||||||||||

| 2021 | 472,905 | (395,730 | ) | 10,185 | - | 87,360 | 344,786 | (113,811 | ) | 53,351 | 488,520 | 772,846 | ||||||||||||||||||||||||||||

| 15 |

| Non-PEO NEOs | ||||||||||||||||||||

| Year | SCT Total | Average Equity Deductions from SCT Total (a) | Average CAP of Equity Vesting During FY (b) | Average CAP of Unvested Equity at FYE (c) | Average Compensation Actually Paid | |||||||||||||||

| 2023 | $ | 659,815 | $ | (299,955 | ) | $ | 4,210 | $ | 39,180 | $ | 403,250 | |||||||||

| 2022 | 639,958 | (349,425 | ) | (62,835 | ) | 248,345 | 476,043 | |||||||||||||

| 2021 | 557,620 | (343,950 | ) | 41,553 | 306,438 | 561,662 | ||||||||||||||

| a) | The amount in these columns represent the grant date fair value of equity-based awards granted during each year. (For this purpose, the fair value of equity awards is computed in a manner consistent with the fair value methodology used to report Outstanding Equity Awards at Fiscal Year-End. This may result in a difference in the share value input used for the fair value calculation at year-end when compared to share value used for performance-based share awards at the time of the award). | |

| b) | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) for awards that are granted and vest in the same applicable year, the fair value as of the vesting date; (ii) for awards granted in prior years that vest in the applicable year, the amount equal to the change in fair value as of the vesting date (from the end of the prior fiscal year). | |

| c) | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change in fair value as of the end of the applicable year (from the end of the prior fiscal year) of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year. |

| (4) | Our non-PEO named executive officers included Mahmud Haq for 2021, 2022 and 2023, Bill Korn for 2021, 2022 and through October 6, 2023 and A. Hadi Chaudhry for the period January 1, 2021 through March 29, 2021. The dollar amounts reported in this column represent the average of the amounts reported for the Company’s NEOs as a group in the “Total” column of the Summary Compensation Table in each applicable year. See note (3) above. | |

| (5) | The dollar amounts reported in this column represent the average amount of CAP to the NEOs as a group, as computed in accordance with the Pay Versus Performance Rules. They do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group during the applicable year. | |

| (6) | Cumulative total shareholder return (“TSR”) is calculated by dividing the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. There were no dividends for the common stock. | |

| (7) | The dollar amounts reported represent the amount of net income (loss) reflected in the Company’s audited consolidated financial statements for the applicable year. While the Company does not use net income (loss) as a performance measure in its executive compensation program, the measure of net income (loss) is correlated with the measure of adjusted EBITDA (a non-GAAP measure) which the Company does use when setting goals for the Company’s incentive compensation program. |

| 16 |

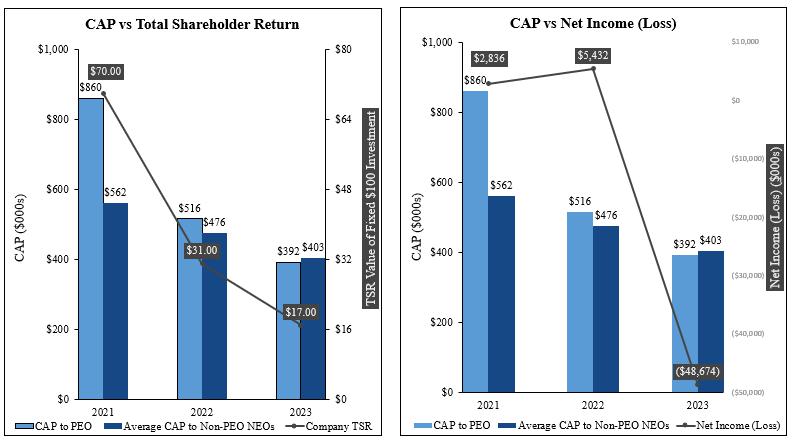

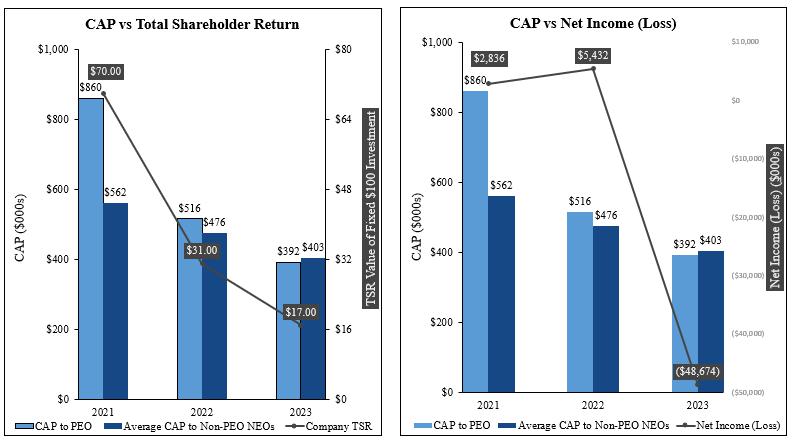

Relationship Between Pay and Performance

Below are graphs showing the relationship of “compensation actually paid” to our PEO and the average for our Non-PEO NEOs in 2023, 2022 and 2021 relative to (i) the Company’s TSR and (ii) the Company’s net income (loss).

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2023, the Compensation Committee of the Board of Directors was comprised of John N. Daly and Cameron P. Munter. Neither of these individuals, during the fiscal year ended December 31, 2023, was an officer or employee of the Company. Neither of these individuals was formerly an officer of the Company.

During the fiscal year ended December 31, 2023, Messrs. Daly and Munter received $48,000 in director compensation, both exclusive of compensation received in the form of stock.

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and set forth in this Proxy Statement. Based on such review and discussions, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K and this Proxy Statement.

COMPENSATION COMMITTEE

John N. Daly

Cameron P. Munter

Executive Employment Arrangements

We are party to employment agreements with each of Messrs. Chaudhry and Haq (the “Employment Agreements”). Each of the Employment Agreements has a two-year term unless earlier terminated, and is automatically renewed at the end of the initial term and annually thereafter in each case, for a one-year term, unless either party provides at least ninety days’ prior written notice of non-renewal.

Each Employment Agreement provides for the payment of base salary and bonus, as well as customary employee benefits. Under each of the Employment Agreements, if the executive’s employment is terminated by the Company without “cause” or by the executive if a “material demotion” occurs (as such terms are defined in the applicable Employment Agreement), the executive shall receive salary continuation payments for the remainder of the contractual term, but in no event for less than twenty-four months. In addition to salary continuation payments, executive shall receive payment of “COBRA” premiums for the executive and his dependents as long as the executive does not become eligible for health coverage through another employer during this severance period. Each of the Employment Agreements also restricts the executive from engaging in a competitive business during his employment and for 12 months thereafter, or soliciting our employees and customers during his employment and for 12 months thereafter.

| 17 |

During 2023 and through the date they left the Company, there were employment agreements with Messrs. DosSantos, Korn and Steenvoorden on terms similar to those described above.

Our Compensation Committee, currently comprised of Messrs. Daly and Munter, are tasked with discharging the Board of Directors’ responsibilities related to oversight of compensation of named executive officers and ensuring that our executive compensation program meets our corporate objectives. The Compensation Committee is responsible for reviewing and approving corporate goals and objectives relevant to the compensation of our named executive officers, as well as evaluating their performance in light of those goals and objectives. Based on this review and evaluation, as well as on input from our Chief Executive Officer regarding the performance of our other named executive officers and his recommendations as to their compensation, the Committee will determine and approve each named executive officer’s compensation annually. As a public company, our named executive officers will not play a role in their own compensation determinations.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table provides information on the current holdings of all outstanding equity awards by our named officers at December 31, 2023:

| Equity incentive plan awards | ||||||||||||||||||||||||

| Name of Beneficial Owner | Number of common shares or units that have not vested | Number of Series B Preferred Shares or units that have not vested | Market value of all shares or units that have not vested | Number of unearned common shares, units or other rights that have not vested | Number of Series B unearned preferred shares, units or other rights that have not vested | Market value of all unearned shares, units or other rights that have not vested | ||||||||||||||||||

| Named Executive Officers | ||||||||||||||||||||||||

| Mahmud Haq, Executive Chairman | - | 12,000 | $ | 78,360 | - | 12,000 | $ | 78,360 | ||||||||||||||||

| A. Hadi Chaudhry, CEO & President | - | 12,000 | 78,360 | - | 12,000 | 78,360 | ||||||||||||||||||

The Series B preferred share units for Messrs. Haq and Chaudhry were not issued.

Employee Benefit Plans

Amended and Restated Equity Incentive Plan. The purpose of the Amended and Restated Equity Incentive Plan (the “Equity Plan”) is to promote our success by linking the personal interests of our employees (including executive officers), directors and consultants to those of our shareholders, and by providing participants with an incentive for outstanding performance. As of December 2023, there were approximately 3,600 employees (including executive officers) eligible to participate in the Equity Plan. The Equity Plan authorizes the grant of awards in any of the following forms:

| ● | Options to purchase shares of common stock, which may be non-statutory stock options or incentive stock options under the Internal Revenue Code (the “Code”). The exercise price of an option granted under the Equity Plan may not be less than the fair market value of our common stock on the date of grant. Stock options granted under the Equity Plan have a term of ten years. | |

| ● | Stock appreciation rights, or SARs, which give the holder the right to receive the excess, if any, of the fair market value of one share of common stock on the date of exercise, over the base price of the stock appreciation right. The base price of a SAR may not be less than the fair market value of our common stock on the date of grant. SARs granted under the Equity Plan have a term of ten years. | |

| ● | Restricted stock, which is subject to restrictions on transferability and subject to forfeiture on terms set by the Compensation Committee. | |

| ● | Restricted stock units, which represent the right to receive shares of common stock (or an equivalent value in cash or other property) in the future, based upon the attainment of stated vesting or performance goals set by the Compensation Committee. |

| 18 |

| ● | Performance stock and cash settled awards, which represent the right to receive shares of common stock or cash, as applicable, in the future upon the attainment of certain stated performance goals. | |

| ● | Preferred stock, which is subject to restrictions on transferability and subject to forfeiture on terms set by the Compensation Committee. | |

| ● | Other stock-based awards in the discretion of the Compensation Committee, including unrestricted stock grants. |

All awards are evidenced by a written award certificate between CareCloud and the participant, which include such provisions as may be specified by the Compensation Committee. Dividend equivalent rights, which entitle the participant to payments in cash or property calculated by reference to the amount of dividends paid on the shares of stock underlying an award, may be granted with respect to awards other than options or SARs.

Awards to Non-Employee Directors. Awards granted under the Equity Plan to non-employee directors may be made only in accordance with the terms, conditions and parameters of a plan, program or policy for the compensation of non-employee directors as in effect from time to time. The Committee may not make discretionary grants under the Equity Plan to non-employee directors.

Shares Available for Awards: Adjustments. Subject to adjustment as provided in the Equity Plan, the aggregate number of shares of common stock reserved and available for issuance pursuant to awards granted under the Equity Plan at December 31, 2023 was 493,579. Also at December 31, 2023, there were 33,769 shares of 11% Series A Cumulative Redeemable Perpetual Preferred Stock and 38,000 shares of 8.75% Series B Cumulative Redeemable Perpetual Preferred Stock reserved and available for issuance under the Equity Plan. In the event of a nonreciprocal transaction between CareCloud and its shareholders that causes the per share value of the common stock to change (including, without limitation, any stock dividend, stock split, spin-off, rights offering, or large nonrecurring cash dividend), the share authorization limits under the Equity Plan will be adjusted proportionately, and the Compensation Committee must make such adjustments to the Equity Plan and awards as it deems necessary, in its sole discretion, to prevent dilution or enlargement of rights immediately resulting from such transaction.

Administration. The Equity Plan will be administered by the Compensation Committee. The Committee will have the authority to grant awards; designate participants; determine the type or types of awards to be granted to each participant and the number, terms and conditions thereof; establish, adopt or revise any rules and regulations as it may deem advisable to administer the Equity Plan; and make all other decisions and determinations that may be required under the Equity Plan. The Board of Directors may at any time administer the Equity Plan. If it does so, it will have all the powers of the Compensation Committee under the Equity Plan. In addition, the Board may expressly delegate to a special committee some or all of the Compensation Committee’s authority, within specified parameters, to grant awards to eligible participants who, at the time of grant, are not executive officers.

Limitations on Transfer: Beneficiaries. No award will be assignable or transferable by a participant other than by will or the laws of descent and distribution; provided, however, that the Compensation Committee may permit other transfers (other than transfers for value) where the Compensation Committee concludes that such transferability does not result in accelerated taxation, does not cause any option intended to be an incentive stock option to fail to qualify as such, and is otherwise appropriate and desirable, taking into account any factors deemed relevant, including without limitation, any state or federal tax or securities laws or regulations applicable to transferable awards. A participant may, in the manner determined by the Compensation Committee, designate a beneficiary to exercise the rights of the participant and to receive any distribution with respect to any award upon the participant’s death.