UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. 2)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

| CareCloud, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CareCloud, Inc.

7 Clyde Road

Somerset, NJ 08873

December 16, 2024

Dear Fellow Shareholder:

It is my pleasure to invite you to attend the Special Meeting of Common Stock Shareholders of CareCloud, Inc. (the “Company”) at 11:00 a.m., Eastern Time, on Monday, January 27, 2025 at our principal executive offices at 7 Clyde Road, Somerset, NJ 08873.

The following pages contain the formal Notice of the Special Meeting and the Proxy Statement. If you plan to attend the Special Meeting, please detach the Admission Ticket from your proxy card and bring it to the Special Meeting. The proxy materials will be first sent or given to shareholders on or about December 16, 2024.

At this Special Meeting, you will be asked to vote on the proposals set forth in the Notice of Special Meeting of Common Stock Shareholders and Proxy Statement, which describes the formal business to be conducted at the Special Meeting and follows this letter.

Your vote is important. Whether you plan to attend the Special Meeting in person or not, we hope you will vote your shares as soon as possible. Please mark, sign, date, and return the accompanying card in the provided postage-paid envelope or instruct us via the Internet as to how you would like your shares voted. Instructions are on the proxy card. This will ensure representation of your shares if you are unable to attend.

| Sincerely, | |

| /s/ Norman Roth | |

| Norman Roth | |

| Interim Chief Financial Officer and Assistant Corporate Secretary |

| i |

NOTICE OF SPECIAL MEETING OF COMMON STOCK SHAREHOLDERS

TO BE HELD ON JANUARY 27, 2025

TIME

11:00 a.m., Eastern Time, on

Monday, January 27, 2025

PURPOSE

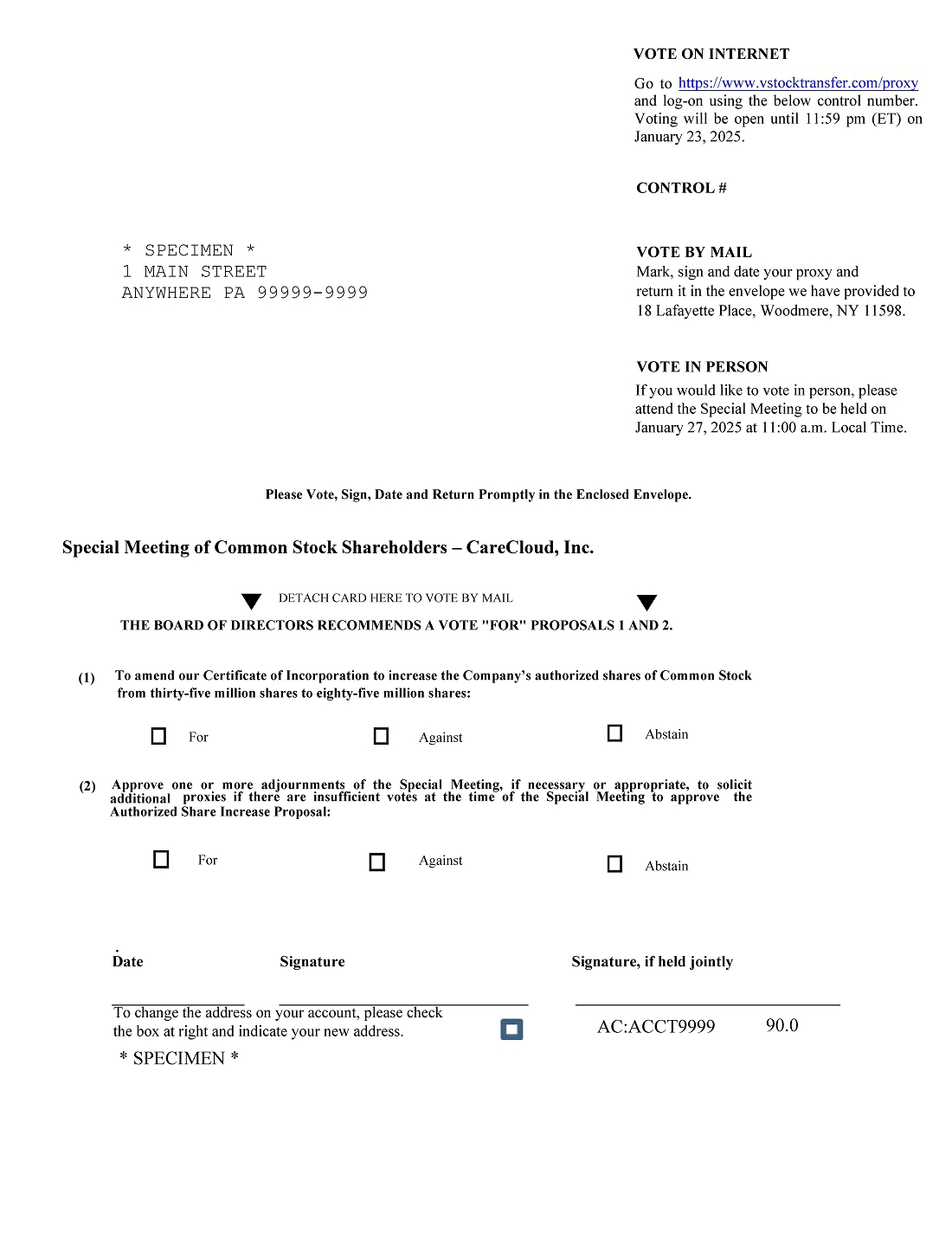

| ● | To amend CareCloud, Inc.’s Certificate of Amendment of Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to increase the Company’s authorized shares of Common Stock from thirty-five million shares to eighty-five million shares (the “Authorized Share Increase Proposal”). | |

| ● | Approve one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Authorized Share Increase Proposal (the “Adjournment Proposal”). |

DOCUMENTS

This Notice is only an overview of the proxy statement and proxy card included in this mailing which is also available at https://ir.carecloud.com/sec-filings. The Notice of Internet Availability will be mailed to shareholders on or about December 16, 2024.

PLACE

The Company’s principal executive offices located at 7 Clyde Road, Somerset, NJ 08873.

RECORD DATE

Owners of shares of the Company’s Common Stock, as of the close of business on December 3, 2024, will receive notice of and be entitled to vote at the Special Meeting and any adjournments.

VOTING

Even if you plan to attend the Special Meeting, please mark, sign, date, and return the enclosed proxy card in the enclosed postage-paid envelope. You may revoke your proxy by filing with the Assistant Secretary of the Company a written revocation or by submitting a duly executed proxy bearing a later date. If you are present at the Special Meeting, you may revoke your proxy and vote in person on each matter brought before the Special Meeting. You may also vote over the Internet using the Internet address on the proxy card. To be considered, all votes must be received by midnight on January 23, 2025.

Norman Roth

Interim Chief Financial Officer and Assistant Corporate Secretary

Dated: December 16, 2024

| ii |

TABLE OF CONTENTS

| iii |

Q: When and where is the Special Meeting?

A: The Company’s Special Meeting of Common Stock Shareholders will be held at 11:00 a.m., Eastern Time, Monday, January 27, 2025, at our principal executive offices at 7 Clyde Road, Somerset, NJ 08873.

Q: Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A: In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our Annual and Quarterly Reports, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials, which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice of Internet Availability also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

Q: Who is entitled to vote?

A: You are entitled to vote at the Special Meeting if the Company’s records on December 3, 2024 (the “record date”) show that you owned the Company’s Common Stock, par value $0.001 (the “Common Stock”) on such date. As of December 3, 2024, there were 16,256,236 shares of Common Stock outstanding.

Q: What will I likely be voting on?

A: There are two proposals that are expected to be voted on at the Special Meeting, which are (i) to amend the Company’s Certificate of Incorporation to increase the Company’s authorized shares of Common Stock from thirty-five million shares to eighty-five million shares (the “Authorized Share Increase Proposal”) and (ii) approve one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Authorized Share Increase Proposal (the “Adjournment Proposal”). As of the date of this Proxy Statement, the Company was not aware of any additional matters to be raised at the Special Meeting.

Q: What is the Board’s recommendation?

A: The Board of Directors recommends that you vote your shares:

| _ | FOR the Authorized Share Increase Proposal | |

| _ | FOR the Adjournment Proposal |

Q: How many votes is each share entitled to?

A: Each share of Common Stock has one vote. The enclosed proxy card shows the number of shares that you are entitled to vote.

Q: Do I need a ticket to attend the Special Meeting?

A: Yes. Retain the top of the proxy card as your admission ticket. One ticket will permit two persons to attend. If your shares are held through a broker, contact your broker and request that the broker provide you with evidence of share ownership. This documentation, when presented at the registration desk at the Special Meeting, will enable you to attend the Special Meeting.

| 1 |

Q: How do proxies work?

A: The Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Special Meeting in the manner you direct. You may also abstain from voting. If you sign and return the enclosed proxy card but do not specify how to vote, we will vote your shares in accordance with our recommendations above.

Q: How do I vote?

A: You may:

| ● | Vote by marking, signing, dating, and returning a proxy card; | |

| ● | Vote via the Internet by following the voting instructions on the proxy card or the voting instructions provided by your broker, bank, or other holder of record. Internet voting procedures are designed to authenticate your identity, allow you to vote your shares, and confirm that your instructions have been properly recorded. If you submit your vote via the Internet, you may incur costs associated with electronic access, such as usage charges from Internet access providers and telephone companies; | |

| ● | Vote in person by attending the Special Meeting. We will distribute written ballots to any shareholder who wishes to vote in person at the Special Meeting. |

If your shares are held in street name, your broker, bank, or other holder of record will include a voting instruction form with this Proxy Statement. We strongly encourage you to vote your shares by following the instructions provided on the voting instruction form. Please return your voting instruction form to your broker, bank, or other holder of record to ensure that a proxy card is voted on your behalf.

Q: Do I have to vote?

A: No. However, we strongly encourage you to vote.

Q: What does it mean if I receive more than one proxy card?

A: If you hold your shares in multiple registrations, or in both registered and street name, you will receive a proxy card for each account. Please mark, sign, date, and return each proxy card you receive. If you choose to vote by Internet, please vote each proxy card you receive.

Q: Will my shares be voted if I do not sign and return my proxy card?

A: If your shares are held in street name and you do not instruct your broker or other nominee how to vote your shares, your broker or nominee may use its discretion to vote your shares on “routine matters”. For any “non-routine matters” being considered at the Special Meeting, your broker or other nominee would not be able to vote on such matters.

Under the rules and interpretations of the NYSE (which by extension apply to all United States brokers, even though the Company’s Common Stock is listed on The Nasdaq Global Market), “non-routine matters” are matters that may substantially affect the rights or privileges of shareholders, such as mergers, shareholder proposals, elections of directors (even if not contested) and executive compensation, including say-on-pay advisory shareholder votes on executive compensation and say-on-frequency advisory shareholder votes on executive compensation.

The Authorized Share Increase and the Adjournment Proposals in this proxy statement are expected to be considered “routine matters,” therefore, your broker or other nominee will have discretion to vote your shares on these proposals without your instructions.

Q: Can I change my vote?

A: Yes. You may revoke your proxy and change your vote before the Special Meeting by submitting a new proxy card with a later date, by casting a new vote via the Internet, by notifying the Company’s Assistant Corporate Secretary in writing, or by voting in person at the Special Meeting. If you do not properly revoke your proxy, properly executed proxies will be voted as you specified in your earlier proxy.

| 2 |

Q: What is a quorum?

A: A quorum is the number of shares that must be present, in person or by proxy, in order for business to be transacted at the Special Meeting. At least a majority of the outstanding shares eligible to vote must be represented at the Special Meeting, either in person or by proxy, in order to transact business.

Q: Who will tabulate the votes?

A: A representative from our Company, Norman Roth, will tabulate the votes and act as inspector of election.

Votes cast by proxy or in person at the Special Meeting will be tabulated by the inspector of election. The inspector will also determine whether a quorum is present at the Special Meeting.

The shares represented by the proxy cards received, properly marked, dated, signed, and not revoked, will be voted at the Special Meeting. If the proxy card specifies a choice with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. Any proxy card that is returned signed but not marked will be voted as recommended by the Board of Directors.

Q: How do I find out the voting results?

A: Preliminary results are typically announced at the Special Meeting. Final voting results will be reported on a Form 8-K filed with the SEC following the Special Meeting.

Q: How are proposals approved by the security holders?

A: In the approvals of the Authorized Share Increase and the Adjournment Proposals, you may vote “For,” “Against” or expressly “Abstain” with respect to this proposal. These proposals are considered routine matters and, as such, brokers have discretion to vote on these proposals without your instruction. Abstentions and broker non-votes will have the effect of a vote “against” these proposals.

Q: Who will bear the costs of this solicitation?

A: Our Board of Directors is making this solicitation on behalf of the Company, and the Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. If you choose to access the proxy materials over the Internet; however, you are responsible for Internet access charges you may incur. The solicitation of proxies or votes may be made in person. We will also reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

Q: What should I do now?

A: You should read this proxy statement carefully and promptly submit your proxy card or vote by the Internet as provided on the proxy card to ensure that your vote is counted at the Special Meeting.

Q: How will shares in the Company’s employee benefit plans be voted?

A: If you are or were a participant in the Company’s employee benefit plans, this Proxy Statement is being used to solicit voting instructions from you with respect to shares of our stock that you own but which are held by the trustees of our benefit plans for the benefit of you and other plan participants. Shares held in our benefit plans that you are entitled to vote will be voted by the plan trustees pursuant to your instructions. Shares held in any employee benefit plan that you are entitled to vote, but do not vote, will be voted by the plan trustees in proportion to the voting instructions received for other shares. You must instruct the plan trustees to vote your shares by utilizing one of the voting methods described above.

| 3 |

Q: How do I obtain a copy of the Company’s materials related to corporate governance?

A: The Company’s Corporate Governance materials, charters of each standing Board Committee, Code of Conduct, and other materials related to our corporate governance can be found in the Corporate Governance section of the Company’s website at https://ir.carecloud.com/corporate-governance/governance-documents.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information, as of December 3, 2024, concerning:

| - | Each person or group of persons known by the Company to own beneficially more than five percent of the outstanding shares of Common Stock, based on information provided by the beneficial owner in public filings made with the Securities and Exchange Commission (“SEC”). | |

| - | Each person who has been a director or executive officer of the Company since the beginning of the last fiscal year. | |

| - | Each nominee for the Board of Directors. | |

| - | Each associate of any of the foregoing persons. |

Unless otherwise noted below, the address of each beneficial owner listed in the table is c/o CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873. Beneficial ownership is determined in accordance with the rules of the SEC, which deem a person to beneficially own any shares the person has or shares voting or dispositive power over and any additional shares obtainable within 60 days through the exercise of options, warrants or other purchase rights. Shares of Common Stock subject to options, warrants or other rights to purchase that are currently exercisable or are exercisable within 60 days of November 29, 2024 (including shares subject to restrictions that lapse within 60 days of the record date) are deemed outstanding for purposes of computing the percentage ownership of the person holding such shares, options, warrants or other rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, each person possesses sole voting and investment power with respect to the shares identified as beneficially owned. The percentages are based on 16,256,236 shares of Common Stock outstanding as of December 3, 2024 and 1,482,792 shares of Series B Preferred Stock outstanding as of December 3, 2024. None of the directors or named executive officers owned Series A Preferred Stock as of December 3, 2024. Each share of Common Stock has one vote.

| Name of Beneficial Owner | Common Stock Beneficially Owned | Percent of Class | Preferred Stock - Series A Beneficially Owned | Percent of Class | Preferred Stock - Series B Beneficially Owned | Percent of Class | ||||||||||||||||||

| Directors and Named Executive Officers | ||||||||||||||||||||||||

| Mahmud Haq, Executive Chairman | 5,034,520 | 31.0 | % | - | - | 5,480 | 0.4 | % | ||||||||||||||||

| A. Hadi Chaudhry, CEO | 114,892 | 0.7 | % | - | - | - | - | |||||||||||||||||

| Stephen Snyder, President | 229,495 | 1.4 | % | - | - | 22,990 | 1.6 | % | ||||||||||||||||

| Norman Roth, Interim CFO | 98,975 | 0.6 | % | - | - | - | - | |||||||||||||||||

| Anne M. Busquet | 251,388 | 1.5 | % | - | - | - | - | |||||||||||||||||

| John N. Daly | 76,750 | 0.5 | % | - | - | - | - | |||||||||||||||||

| Bill Korn | 167,883 | 1.0 | % | - | - | 10,800 | 0.7 | % | ||||||||||||||||

| Cameron P. Munter | 189,000 | 1.2 | % | - | - | - | - | |||||||||||||||||

| Lawrence S. Sharnak | 84,000 | 0.5 | % | - | - | - | - | |||||||||||||||||

| All current directors and executive officers as a group (9 persons) | 6,246,903 | 38.4 | % | - | - | 39,270 | 2.7 | % | ||||||||||||||||

| 4 |

| 1. | Amend the Company’s Certificate of Incorporation to increase the Company’s authorized shares of Common Stock from thirty-five million shares to eighty-five million shares. |

(Item 1 on proxy card)

Our Board of Directors has authorized, approved and declared advisable an amendment to our Certificate of Incorporation that increases the number of authorized shares of our Common Stock from thirty-five million shares to eighty-five million shares. The proposed amendment is subject to approval by our shareholders.

Our Board of Directors believes that it is advisable and in our best interests and the best interests of our shareholders to amend the Certificate of Incorporation in order to have available additional authorized but unissued shares of Common Stock in an amount adequate to provide for our future needs including acquisitions, conversion of the Company’s outstanding Preferred Stock and other general corporate purposes.

The proposed amendment is attached hereto as Appendix A.

Required Vote

The affirmative vote of the holders of more than 50% of the Common Stock that is outstanding and entitled to vote at the Special Meeting is required to approve the Authorized Share Increase Proposal. You may vote for, against or expressly abstain with respect to this proposal. The Authorized Share Increase Proposal is considered a routine matter and, as such, brokers will have discretion to vote on this proposal without your instruction.

The Board of Directors unanimously recommends a vote FOR the approval of the Authorized Shares Increase Proposal.

| 2. | Approve one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Authorized Share Increase Proposal. |

(Item 2 on proxy card)

Our shareholders will be asked to approve a proposal to approve one or more adjournments of the Special Meeting to a later date or time, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Authorized Share Increase Proposal.

If the Common Stock shareholders approve the Adjournment Proposal, we could adjourn the Special Meeting and any adjourned session of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from Common Stock shareholders that have previously returned properly executed proxies voting against the approval of the Authorized Share Increase Proposal.

We do not intend to call a vote on this proposal if the Authorized Share Increase Proposal is approved at the Special Meeting.

Required Vote

The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy at the Special Meeting is required for the Adjournment Proposal; provided, that in the absence of a quorum, the affirmative vote of the holders of a majority of the shares of Common Stock represented thereat is required for the Adjournment Proposal. Approval of the Adjournment Proposal is not a condition to the approval of the other proposal. You may vote for, against or expressly abstain with respect to this proposal. The Adjournment Proposal is considered a routine matter and, as such, brokers will have discretion to vote on this proposal without your instruction.

The Board of Directors unanimously recommends a vote FOR the approval of the Adjournment Proposal.

OTHER BUSINESS

Our Board of Directors does not presently intend to bring any other business before the Special Meeting, and, so far as is known to the Board of Directors, no matters are to be brought before the Special Meeting except as specified in the Notice of Special Meeting of Common Stock Shareholders. We have not been informed by any of our Common Stock shareholders of any intention to propose any other matter to be acted upon at the Special Meeting. The persons named in the accompanying Proxy are allowed to exercise their discretionary authority to vote upon any other business as may properly come before the Special Meeting. As to any such other business that may properly come before the meeting, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

| 5 |

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only one Notice of Internet Availability is being delivered to multiple security holders sharing an address unless we receive contrary instructions from one or more of the security holders. We shall deliver promptly, upon written or oral request, a separate copy of the Notice of Internet Availability to a security holder at a shared address to which a single copy of the document was delivered. A security holder can notify us that the security holder wishes to receive a separate copy of the Notice of Internet Availability by sending a written request to us at Investor Relations, CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873, or by calling us at (732) 873-5133. A security holder may utilize the same address and telephone number to request either separate copies or a single copy for a single address for all future proxy statements, if any, Notices of Internet Availability, and Special reports of the Company.

SHAREHOLDER PROPOSALS FOR 2025 ANNUAL MEETING OF SHAREHOLDERS

Shareholder proposals intended for inclusion in our proxy statement and form of proxy relating to our 2025 Annual Meeting of Shareholders must be received by us not later than December 11, 2024. If we hold our 2025 Annual Meeting of Shareholders more than 30 days before or after June 17, 2025 (the one-year anniversary date of the 2024 Annual Meeting of Shareholders), we will disclose the new deadline by which shareholder proposals must be received under Item 5 of Part II of our earliest possible Quarterly Report on Form 10-Q or, if impracticable, by any means reasonably determined to inform shareholders. In addition, shareholder proposals must otherwise comply with the requirements of Rule 14a-8 under the Exchange Act. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of shareholder proposals in company-sponsored proxy materials. Proposals should be addressed to: Assistant Corporate Secretary, CareCloud, Inc., 7 Clyde Road, Somerset, New Jersey 08873.

Our bylaws also establish an advance notice procedure for shareholders who wish to present a proposal before an Annual meeting of shareholders but do not intend for the proposal to be included in our proxy statement. Under our bylaws, director nominations and other business may be brought at an Annual Meeting of Shareholders only by or at the direction of our Board of Directors or by a shareholder entitled to vote who has submitted a proposal in accordance with the requirements of our bylaws as in effect from time to time. Notice of Shareholder proposals for the 2025 Annual Meeting of Shareholders, other than proposals intended for inclusion in our proxy statement as set forth in the preceding paragraph, must be received by the Assistant Corporate Secretary at our principal executive offices between January 23, 2025 and February 27, 2025. This advance notice period is intended to allow all shareholders an opportunity to consider all business and nominees expected to be considered at the meeting. Please refer to the full text of our advance notice bylaw provisions for additional information and requirements. In addition to satisfying the deadlines in the advance notice provision of our bylaws, a shareholder who intends to solicit proxies in support of director nominees, other than our nominees, for our 2025 Annual Meeting of Shareholders must provide the notice required under Rule 14a-19 under the Exchange Act to our Assistant Corporate Secretary no later than March 23, 2025.

Only such proposals as are (1) required by the rules of the SEC and (2) permissible under the Delaware General Corporation Law will be included on the 2025 Annual Meeting of Shareholders agenda. If a shareholder who has notified us of his or her intention to present a proposal at an Annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for a vote at such meeting.

ANNUAL REPORT ON FORM 10-K AND QUARTERLY REPORT ON FORM 10-Q

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and a copy of our Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2024, as filed with the SEC, accompanies this Proxy Statement. Such reports include our financial statements and certain other financial information, which are incorporated by reference herein.

A copy of our Annual Report on Form 10-K and our Quarterly Report on Form 10-Q will be mailed without charge to any beneficial owner of our Common Stock, upon written or oral request. Requests for the Annual Report on Form 10-K and/or the Quarterly Report on Form 10-Q should be addressed to: Investor Relations, CareCloud, Inc., 7 Clyde Road, Somerset, NJ 08873 or by telephone at (732) 873-5133, x134; please make your request for a copy on or before January 10, 2025 to facilitate a timely delivery. The Form 10-K and Form 10-Q include certain exhibits. Copies of the exhibits will be provided only upon receipt of payment covering our reasonable expenses for such copies. The Form 10-K and Form 10-Q and exhibits therein may also be obtained from our investor relations website, http://www.viewproxy.com/carecloud/2024sm or directly from the SEC’s website, http://www.sec.gov/edgar.shtml.

| 6 |

CERTIFICATE OF SECOND AMENDMENT OF

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

CARECLOUD, INC.

CareCloud, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST: That at a meeting of the Board of Directors of CareCloud, Inc., resolutions were duly adopted setting forth a proposed amendment of the Amended and Restated Certificate of Incorporation of said corporation, declaring said amendment to be advisable and calling a meeting of the shareholders of said corporation for consideration thereof. The resolution setting forth the proposed amendment is as follows:

RESOLVED, that the Amended and Restated Certificate of Incorporation of this corporation be amended by changing the Article thereof numbered “4.1” so that, as amended said Article shall be and read as follows:

4.1 Classes of Stock. The Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares which the Corporation is authorized to issue is 92,000,000 shares, consisting of 85,000,000 shares of Common Stock and 7,000,000 shares of Preferred Stock, each with a par value of $0.001 per share.

SECOND: That thereafter, pursuant to resolution of its Board of Directors, a meeting of the shareholders of said corporation was duly called and held upon notice in accordance with Section 222 of the General Corporation Law of the State of Delaware at which meeting the necessary number of shares as required by statute were voted in favor of the amendment.

THIRD: That said amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS HEREOF, said corporation has caused this certificate to be signed this xth day of January, 2025.

| By: | ||

| Name: | A. Hadi Chaudhry | |

| Title: | Chief Executive Officer |

| A-1 |